From Etisalat to 9Mobile and the struggles after, its new CEO Alan Sinfield is charting a new course for the company in data and digital services.

For the last decade, 9Mobile was Nigeria’s fourth-largest telco. After making a powerful entry, using a clever PR campaign hinged on the catchy “0809ja” theme song, the company catapulted itself to a place of relevance. Until 2017, 9Mobile was called Etisalat Nigeria, a brand name it inherited from one of its major shareholders, the UAE’s Emirates Telecommunication Group Company.

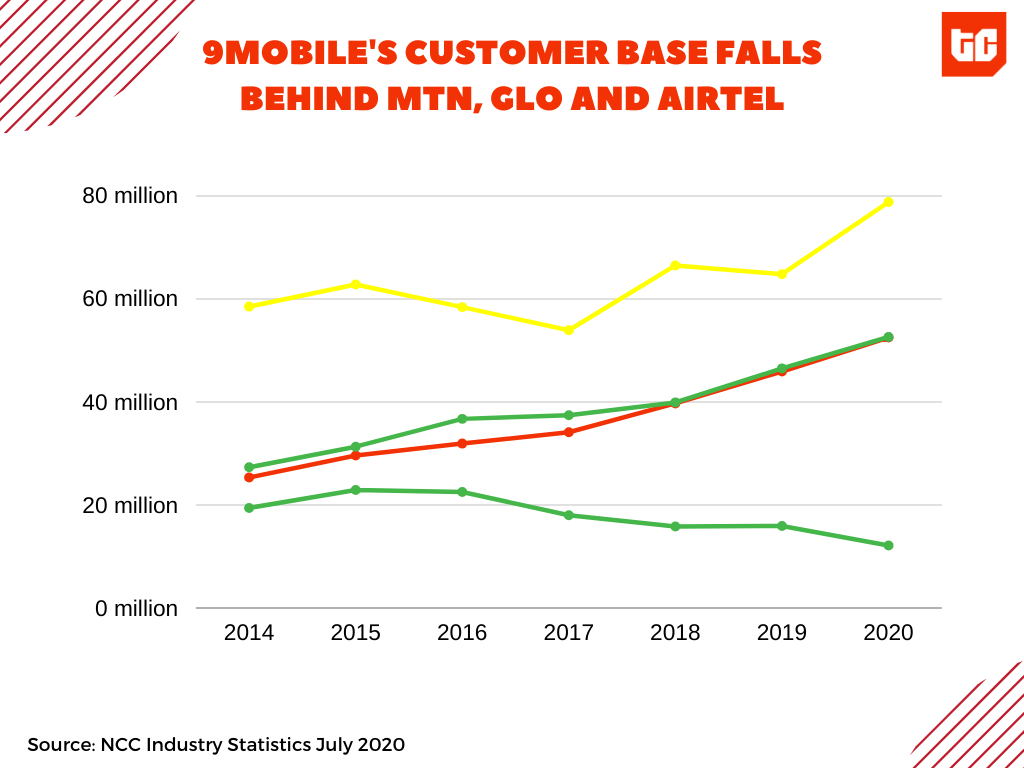

While it played catch up to the other three dominant telcos (MTN, Airtel and Glo), the then-Etisalat wasn’t completely behind. In October 2014, six years after its full commercial launch, the company had 20.2 million mobile subscribers. Its closest competitor at the time, Airtel had 26.5 million after 13 years in operations.

Etisalat appeared to have huge growth potential at a time when high oil prices fuelled a historic boom for the Nigerian economy. To position itself for this growth, in 2013 the telco secured a $1.2 billion syndicated loan from 13 Nigerian banks to expand its network. Its future looked promising.

But its luck would change quickly.

By late 2014, the commodities boom began to wane, causing oil prices to decline. Nigeria was particularly vulnerable and by 2015 a currency crisis ensued, leading to a devaluation a year later. The value of Nigeria’s currency fell by 55% in 2016.

Like many businesses, that devaluation hurt Etisalat, causing its loan value to rise, Frank Eleanya, a journalist at Business Day, tells TechCabal.

The company’s situation worsened as it was unable to reach a loan restructuring agreement. This debt crisis forced its UAE investors; Mubadala, the UAE fund, and Etisalat to exit the company in 2017.

The telco rebranded as 9Mobile following these exits. Creditors were still on its heels, ready to sell off whatever they thought was valuable.

An utter collapse was prevented when government regulators intervened and instituted a bidding process. 9Mobile was sold in late 2018, despite some controversies and intrigues, to a new investor: Teleology Nigeria. That acquisition has somewhat restored balance at the company’s top management. Bloomberg reported in November 2018 that Teleology had started repaying the previous loan starting with a $251 million payment.

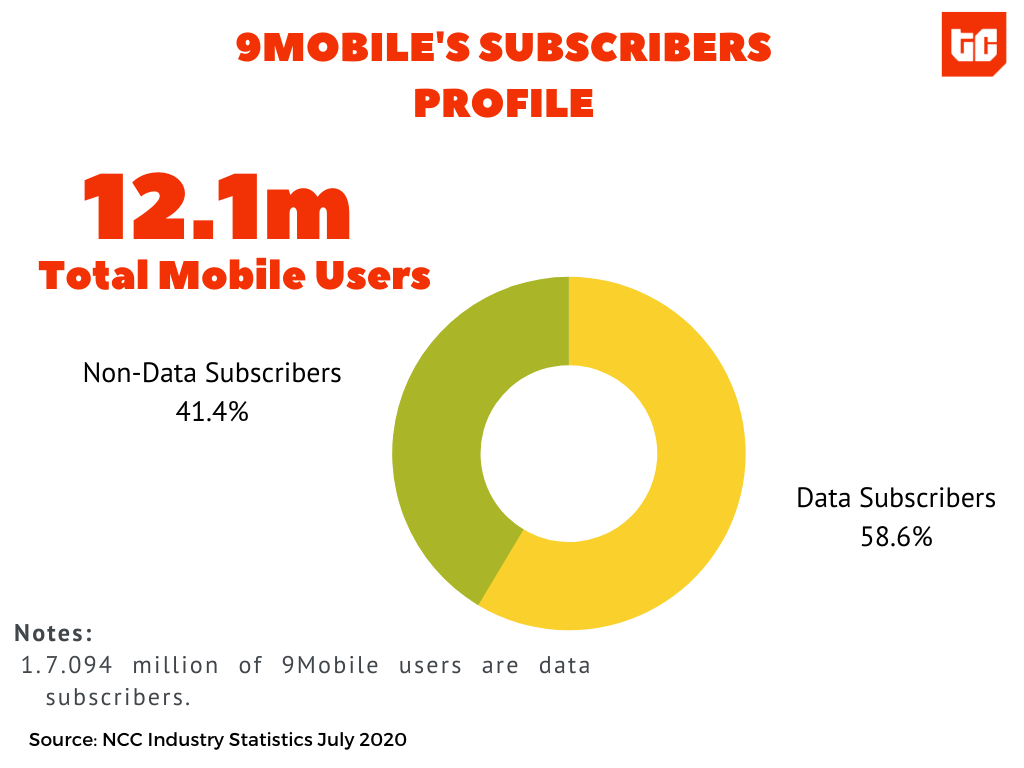

Yet, during this debt crisis and sale process, 9Mobile’s customer base was in free fall. In September 2015, Nigeria’s fourth major telco had 23.5 million subscribers. By July 2020, its customer base had dropped to 12.1m, losing 11.4 million subscribers within five years. It has lost subscribers every month since March 2019 and is now far behind Airtel (52.5m subscribers), Nigeria’s third major telco.

By June 2020, 9Mobile came under new leadership. Alan Sinfield, a telecom industry veteran was hired as new CEO. Sinfield boasts an impressive resume, having led a number of telecom companies in almost every region of the world.

“I think I’ve worked in every single country in the Middle East, a lot of Far East countries, virtually every country in Europe, but also a number of African countries as well… like Sudan, Mauritania, Chad, Mali and South Africa,” Sinfield tells TechCabal.

“I think the only continent I have not worked in is South America,” he says.

At 9Mobile, Sinfield has a difficult task ahead of him and he knows it.

Reviving 9Mobile

Two of the biggest tasks for the new CEO are to win back subscribers while growing revenues as telecom voice services continue to suffer an expected decline.

Interestingly, the telco market globally has become a slow-growth environment. Operators are increasingly expanding to non-core businesses like media, financial and enterprise services to pursue growth. In a recent report, industry body GSMA explains that “[a]dding new subscribers are increasingly difficult as markets become saturated and the economics of reaching rural populations become more difficult to justify in a challenging financial climate for mobile operators.”

Over-the-top (OTT) services from Google, Facebook and other internet companies have significantly squeezed off revenues from telecom operators. According to GSMA [PDF], much of the recent growth by telecom companies is coming from mergers and acquisitions as well as organic mobile subscriber growth in underpenetrated, large-scale markets.

To 9Mobile’s Sinfield, although Nigeria already has a large number of mobile subscribers, the market is still underserved.

“The thing that excited me the most about 9Mobile is the scale of the opportunity,” Sinfield tells TechCabal. “The market is incredibly dynamic, challenging of course, but incredibly dynamic. And from everything I had seen before arriving has huge amounts of growth potential.”

9Mobile’s smaller position in the market today is not necessarily a bad thing, Sinfield suggests. “You can view this in two ways,” he says.

“We’re the fourth largest at the moment with a fairly smaller footprint in terms of network size. You can view that as a weakness or you can view that as a positive.”

Nigeria is a frontier market, he says. “Not an emerging market, but a frontier market, where it has the opportunity to leapfrog technologies because it’s not burdened with all of the legacy things that all the more mature markets are.”

He explains that as a smaller telco, 9Mobile has “the potential to adopt all of these new strategies and ideas and advanced technologies quickly.”

“[This is what] I think excited me most about [joining].”

Alan Sinfield is pushing 9Mobile deeper into data services

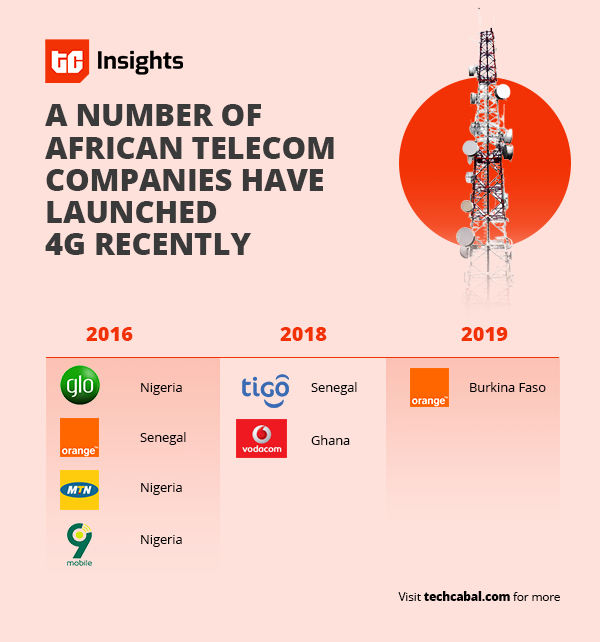

A key part of Sinfield’s vision for 9Mobile is to make a solid transition to data and digital services. The telco already started on this path years ago when it launched its 4G LTE services in 2016, one of the earliest telcos to do so on the continent. In the same year, two other Nigerian telcos (MTN and Glo) unveiled their own 4G broadband infrastructure as competition became fierce.

However, Sinfield appears to be pushing for a more pragmatic approach to broadband deployment. “It’s less to do with that technology and more to do with what that technology provides,” he tells TechCabal.

“There is a huge potential for the future for further broadband deployment,” he says, “and I’m saying broadband deployment because I think we should not be caught up in focusing just on the technology that’s there, like 4G, 4G+, LTE, etc.”

“It’s about the evolution from 4G to 5G and it’s also about looking up to the other different avenues that we can employ to deliver fast broadband to our customers.”

Sinfield says his focus is on digital services. “Data is key,” he said, “and we’re positioning ourselves so that we’re strongly contending in that space going forward.”

9Mobile is extending its broadband coverage and is currently available in 16 major cities, Sinfield told TechCabal. In August 2019, the company secured a $230 million loan from the African Finance Corporation (AFC) to “honor existing debts, finance its costs and invest in growth.” Before the coronavirus outbreak, 9Mobile had planned to extend its data services with 100 sites in rural and urban areas of Nigeria. These efforts are important to a shift from traditional voice services.

While Sinfield acknowledges that voice services revenues are declining for telcos, he also believes that voice services remain important but the delivery mechanism will have to evolve as telecom subscribers switch to OTT services. Essentially, a reclassification will happen, he believes.

“Nigeria has huge growth ahead of it for that because it still has a very high dominance when it comes round to voice calls and SMS as opposed to the OTT voice over IP (VoIP) variant,” Sinfield explains. “[And] we’re positioning ourselves so that we manage the transition from the traditional voice to OTT voice.”

The new 9Mobile boss lays down an instructional understanding of what direction the telco will go, saying it is not about concentrating on one service at a time.

“It’s about all of the other elements of digital services that you can offer so that you remove yourself from being just the dump pipe,” he explains. “So that you’re there either offering full-on OTT services in competition with the main ones [Facebook, Apple, Google, Zoom] or that we’re building partnerships with them so that we’re also able to benefit from the revenue streams that they generate.”

And as these major OTT services witness increasing adoption in Nigeria, Sinfield “fully endorses” government efforts to introduce digital tax.

“The OTT players have been riding on the backs of telco companies for many years and in some ways that’s very good,” he said praising them for reducing access to knowledge and digital services. “So I would never say it is anything that should be diminished,” he added.

“However, I do also believe very strongly that those international behemoths [Facebook, Google] are earning significant revenues from Nigerian consumers, [and] not just in Nigeria, but worldwide. And it’s time that they paid back.”

From live TV to financial services; how 9Mobile attempts to diversify its revenue streams

Since 2019, 9Mobile has doubled down on this pivot to data and digital services. In July 2019, in partnership with Super Network Africa, the telco announced SuperTV, a new streaming video-on-demand (SVOD) app. According to its app store description, SuperTV supports live TV programming as well as on-demand videos series and movie catalogue.

SuperTV has an interesting pricing and content delivery approach. Unlike rival products like AirtelTV, SuperTV users can stream content without an active internet data subscription.

The app itself has a paid subscription bundle. This allows 9Mobile’s 7 million data subscribers to watch content without additional data cost. It is similar to how a product like DStv Mobile operated in the early 2010s. SuperTV subscription prices range from as low as N50 to N3,500.

Michael Ataga, CEO of Super Network Africa, believes “there is a large market for affordable entertainment on demand anywhere.” The Nigerian market has unmet needs, he says. His company plans to add over 100 international channels when the SuperTV app fully rolls out sometime in 2020.

Sinfield is on board with the plan, and says 9Mobile has “plans around further enhancing on our IPTV switch for the [Nigerian] market.”

In addition to SuperTV, in April 2019, 9Mobile partnered with medical startup, Mobihealth International to provide telemedicine services to Nigerians.

9Mobile is also expanding into financial services. “There’s a huge potential in the market,” he says. “And providing the people with access to banking services and then onward to digital services is one way in which we can further develop the country and the people going forward.”

In 2018, 9Mobile partnered with Nigerian bank, UBA to roll out 9Pay, a mobile payments solution. The telco is also pushing for a fintech licence. It has already secured approval in principle for a Payments Service Bank licence since 2019. Once fully operational, 9Mobile will provide basic banking services mostly in rural locations where the population is unbanked.

Sinfield did not give a timeline for the launch of the new fintech service, but says: “we’ve been working very hard to prepare our business and our business model for that.”

“We’re very close in terms of the platforms and how the developments of the platforms underpin the services we provide in the market and the services we offer in the market”.

“I guess the best thing I can say is to watch this space.”