IN PARTNERSHIP WITH

Good morning ☀️ ️

If you live in the US, TikTok may owe you money!

Last year, 21 federal suits were filed against TikTok for data privacy violations. The plaintiffs (legalese for accusers) alleged that TikTok collected personal data from users and shared it with third parties without users’ consent.

While TikTok denied the allegations, it moved for an out-of-court settlement at a price of $92 million which can be paid to its 82 million users in the States.

Unfortunately, one person ≠ one million dollars; math never works the way you want it to 🤧. If all eligible persons submit a claim, everyone nationwide would get $0.96 while those in Illinois would receive up to $5.75.

If you want to receive your claim, you’ll have to file before March 2022, although we reckon that it could cost more than it’s worth.

In today’s edition

- Ghana’s new levy on e-transactions

- The face of the global lockdown

- TC Insights: Nigeria’s digital scorecard

- Sudan partially resumes internet services

- Tech Probe

GHANA’S NEW LEVY ON E-TRANSACTIONS

From February 2022, every electronic transaction in Ghana will be accompanied by a 1.75% charge.

The country is imposing an electronic transaction levy—e-levy—to “widen the tax net and rope in the informal sector”, according to an announcement by Finance Minister, Ken Ofori-Atta.

From mobile money payments and bank transfers to merchant payments and inward remittances, originators of electronic transactions pay the levies with the exception of inward remittances where the recipient bears the cost.

However, transactions up to GH¢100 ($16) per day will be exempted.

There’s Ghana be a problem

People aren’t happy about this as they speculate that the Ghanaian government—eyeing the $81 billion made in digital transactions last year—is following in Uganda’s footsteps to increase government revenue by taxing internet usage.

Regardless of any opposition, they may not have a choice.

In Ghana, electronic transactions, i.e. mobile money, are the most effective form of transferring money because, unlike bank transfers, are accessible to all. Ghana has the third-largest mobile money market in the world, with a transaction value of $68 billion in 2020.

Read more: There will be no escaping Ghana’s new levy on electronic transactions.

THE FACE OF THE GLOBAL LOCKDOWN

Last year, during the global lockdown, Nigerian-born international visual artist, Ade Adekola, made an open call on Instagram for people who were interested in having their photographs turned into portraits.

He opened a sign-up form with a commitment to do 30 portraits, but when he opened the form two hours later, the number of requests had exceeded 80. He had to close the call immediately to avoid being overwhelmed.

During the process of creating the portraits—all 80 of them—he was able to improve his creative process, developing new techniques that helped him optimise the way he worked. He took the original photographs shared by interested persons, stripped them of all colours, turning them into black and white. He then turned them into engravings, before shading, cutting, and colouring them. Optimising this process, coupled with the overwhelmingly positive feedback he received from his 80 selected muses, encouraged him to create more portraits.

In the end, Adekola created 700 portraits, but there are only 40 portraits with striking designs and a collage of all 700 portraits on display at the exhibition halls of the gallery.

Sultan Quadri paints a clearer picture in The NFT artist who captured the global lockdown with 700 portraits.

Accept international payments from your customers in the USA, UK, Canada, and 60+ countries using Pay with Apple Pay.

👉🏾Create a free Paystack account to get started.

This is partner content.

TC INSIGHTS: NIGERIA’S DIGITAL SCORECARD

Nigeria’s digital economy is growing at an impressive pace. The country is home to the highest number of startups in Africa—many of which are innovating across healthcare, financial services, and education. In the past few years, they have attracted over a billion dollars in venture capital, creating new jobs in the process.

Although this is impressive, the country ranks 82nd out of 110 countries on the Surfshark digital quality of life index, with a score of 0.46. Digital quality of life examines the gaps between the online experiences of citizens of different countries across the globe. It is calculated using these five metrics: internet affordability, internet quality, e-infrastructure, e-security, and e-government.

Nigerians have to work more than 35 hours to afford the cheapest broadband internet plan. This is 90% worse than the global average of 5 hours, 45 minutes. The country also lags behind in terms of electronic government ranking 95th out of the 110 countries included in the report.

As the internet continues to play an important role in the lives of people across the globe, it is important that Nigeria improves its capacity to partake in this wave and usher in more economic prosperity. Although the country has taken some major steps in this direction, there’s still a lot that needs to be done.

For example, it recently started to pursue a National Identity Number (NIN) policy. However, as of November 2021, only 67 million Nigerians had registered for the NIN, signifying a completion rate that’s less than 50%. While issuing an identity number is a step in the right direction, the government needs to go beyond that to ensure its processes and services are digitised for Nigerians to access them easily.

Here’s another one: the government has released a new National Broadband Plan that recognises that varying right of way fees is one of the reasons internet costs remain out of the reach of many. Despite previous waivers and a reduction in the fee, only seven states across the country have implemented it.

A nation with huge ambitions such as Nigeria must invest heavily in infrastructure to improve the digital well-being of her citizens and ensure that its digital economy continues to grow.

You can download all our reports here and watch videos from our events. Send your custom research requests here.

Join the Future Africa Collective—an exclusive community of investors who invest in startups building the future. With a $300 quarterly fee, you get access to invest a minimum of $2,500 in up to 5 high-growth African startups.

This is partner content.

SUDAN PARTIALLY RESUMES INTERNET SERVICES

Internet service was partially restored in Sudan Thursday evening, three weeks after it had been shut off in the country. The decision was made following a court order to telecom companies calling for immediate restoration of the internet.

What’s going on in Sudan?

On October 25, Sudan’s military seized control from the country’s transitional government, the military-civilian Sovereign Council. Led by General Abdel Fattah al-Burhan, the coup ignited street protests across the country that denounced the military takeover. The Sudanese military then shut down the internet, limiting the world’s ability to stay informed about the nature of the conflict.

Sudan is not alone

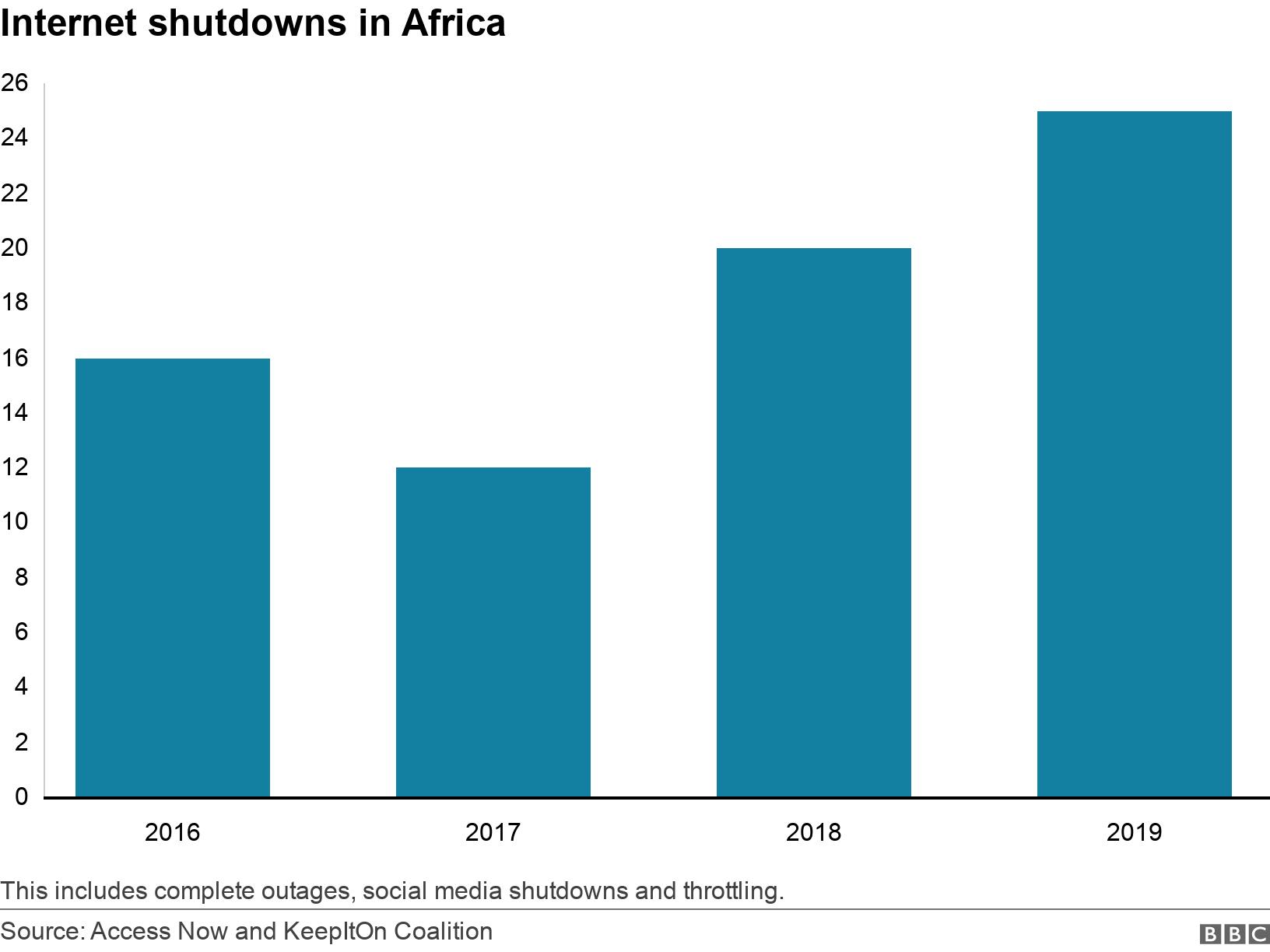

Internet shutdowns and restricted access to the internet are on the rise in Africa. According to research conducted by Access Now and KeepItOn Coalition, in 2019, there were 25 documented instances of partial or total internet shutdowns, a 25% increase from the number of shutdowns in 2018, and 47% increase from shutdowns in 2017.

But telcos are the ones with the power to shut internet services down. Should they be expected to resist government orders to censor the web?

Save 50% on transaction costs with instant, linked-account payments. Ideal for wallet funding, loan repayments, collections, and e-commerce checkouts.

Learn more here.

This is partner content.

TECH PROBE

Tech Probe is usually reserved for questions that hound the ecosystem, but we’re hijacking this week’s edition.

We could write about crypto, or regional roundups, or even digital culture pieces on how young Nigerians can thrive with remote work, but you’re part of the Cabal and we’d like to give you a voice.

What would you like to read from TechCabal in December? A list of the best anime to binge on? A brief data-driven piece on up-and-coming tech startups?

If it’s related to tech and you want to read it, let us know.

JOB OPPORTUNITIES

Every week, we share job opportunities in the African ecosystem.

- Big Cabal Media – Software Developer, Talent Operations Analyst – Lagos, Nigeria

- Deloitte Africa – Human Resource Intern – Nairobi, Kenya

- M-KOPA – Senior Manager, Customer Retention, Fraud Manager – Kampala, Uganda

- Vodafone – Product Manager – Ghana

- MarketForce – National Sales Manager – Kigali, Rwanda

There are more opportunities here. If you’d like to share a job opening or an opportunity, please fill this form.

What else we’re reading

- When was the last time you updated your password? It’s 2021 and the most common password is still 123456.

- Nigeria’s Kuda Bank has caught a lot of attention after it closed accounts of its customers trading crypto. Here’s what’s happening there.

- Google might be looking at a ban on its smart home and phone products as Sonos Inc’s infringement claim against it heats up.

- The viral “where we ’bout to eat at” kid has passed away.