IN PARTNERSHIP WITH

Sigh. Monday again. 🤧

Instagram has added an upgrade to its Live feature.

It will now let streamers appoint moderators during streaming.

Now, instead of getting distracted by commenting trolls, you can now let someone get distracted for you instead. Moderators can report comments, remove users from the Live, and turn off commenting.

To appoint a moderator, tap the three dots in the comment bar during a Live, then choose a moderator from a list of suggested accounts, or use the search bar to search for a specific account.

In today’s edition

- Nigeria shuts down 6 digital loan companies

- Nigerian banks are limiting international spending limits

- Russia is suing Meta

- TC Insights: Informal retail meets tech

- Job opportunities

NIGERIA SHUTS DOWN 6 DIGITAL LOAN COMPANIES

Nigerian authorities are cracking down on digital loan companies with predatory practices.

Last week, 3 federal agencies—the Federal Competition and Consumer Protection Commission (FCCPC), National Information and Technology Development Agency (NITDA), and the Independent Corrupt Practices and Related Offences Commission (ICPC)—raided 6 of these illegal companies in a joint task effort.

Who went down?

Six companies namely GoCash, Okash, EasyCredit, Easi Moni, KashKash, and Speedy Choice, none of which are reportedly registered in Nigeria or had operating licenses.

The federal agencies’ action is the culmination of 2 years’ worth of work. Babatunde Irukera, the CEO of the FCCPC said the investigation into the companies started in 2020, at the onset of the pandemic when people needed loans to keep their businesses afloat. Soon after, consumers started accusing the loan companies of mishandling and violating their private data in the process of loan recovery.

After months of investigation, the agencies were able to collate their findings into three points: high-interest rates charged by the lenders, unethical loan recovery methods, and violation of consumer privacy.

It’s not the first time, nor the last

In August 2021, Nigerian authorities began the crackdown on predatory lenders with NITDA fining Soko Loan ₦10 million ($23,800) for invasion of privacy.

At the time, the agency promised to checkmate more lenders but nothing was announced till now.

With this latest development, the agencies have also promised that they aren’t stopping there. “It doesn’t also mean that the people we are proceeding against today are the only ones—no. We want to start with them. We also understand that there are between 5 and 7 companies operating at the same location,” said Irukera.

Zoom out: It’s slow but African countries are walking up to check the excesses of digital lenders and their debt-shaming practices. In December, Kenya enacted a law that mandates all lenders within the country to apply for licenses which in turn means they have to adhere to consumers’ data protection legislation. Nigeria doesn’t have anything of the sort yet but an amendment to the NITDA Act seeks to address it.

Yet to get paid for your hilarious tweets?

Simply add Barter to your Twitter profile and start accepting tips and donations from your followers.

Learn how to set up Barter for Tips.

This is partner content.

NIGERIAN BANKS ARE LIMITING INTERNATIONAL SPENDING LIMITS

How much, in dollars, do you spend a month? Think of your Spotify/YouTube Premium subscriptions, your Netflix subscriptions, your mini shopping sprees on Amazon?

For Nigerians who use Zenith, GT, or UBA banks, that amount will be limited to $20 per month. For First Bank users, it’s $50 (₦25,000). This month, 4 banks announced reduced limits on international transactions using naira debit cards from $100 (₦50,000) to $20 (₦10,000) per month. The banks also suspended the use of naira debit cards for any payments or withdrawals outside the country.

That means the naira debit cards of these banks are useful within the country alone.

What’s more, Nigerians fear that other commercial banks will soon follow suit.

Why’s this happening?

Courtesy of ex-Cabalian Olumuyiwa Olowogboyega at Notadeepdive, Nigerian banks have had a rather alarming history of reducing international spending limits with Banks like Fidelity Bank reducing theirs from $3,000 to $1,000 in 2020. In that same year, others reduced theirs with Stanbic IBTC and GT Bank reducing from $500 to $100.

But why are banks placing these limits?

Well, Nigeria depends on its oil revenue for foreign exchange earnings. Over 90% of its foreign exchange is dependent on its crude oil exports.

Unfortunately, though, the pandemic triggered a drop in oil prices. In May 2020, the country lost around 80% of oil revenue due to the crash in oil prices COVIDand it hasn’t been able to recover since.

What’s next?

Nigerians, understandably, aren’t happy with many explaining that the limits can’t cover their dollar expenses.

The good news is that fintechs that offer dollar cards at the touch of a button already exist. For example, Flutterwave’s Barter allows users to create and fund their dollar cards within minutes. The cards can be used for international payments within and outside Nigeria. Wallets Africa and Bitsika also allow users create virtual dollar cards anyone can use.

At Busha, we want everyone everywhere in Nigeria to have access to crypto. That’s why you can buy as low as ₦250, set recurring buys, get the best rates, and soon 🤐 on Busha. Join 300,000+ Nigerians already using Busha.

This is partner content.

RUSSIA IS SUING META

Yep, you heard right.

Russia’s Investigative Committee has opened a criminal case against Facebook’s parent company, Meta and it’s unsurprising.

What’s happening?

Last week, Meta amended Facebook and Instagram’s amended User Policies to allow for hate speech and violence against Russian soldiers, Russian president Vladimir Putin, and Belarusian president Alexander Lukashenko.

According to Meta, users in Ukraine, Armenia, Azerbaijan, Estonia, Georgia, Hungary, Latvia, Lithuania, Poland, Romania, Russia and Slovakia will be allowed to make “forms of political expression that would normally violate our rules like violent speech such as ‘death to the Russian invaders'”.

The exception to Meta’s Hate Speech Permit is hate speech or violence targeted at Russian civilians.

Meta’s head of global affairs, Nick Clegg, said the policy shift is “focused on protecting people’s rights to speech as an expression of self-defence in reaction to a military invasion of their country”.

The problem

There are problems with Meta’s stance.

For one, Meta and most social media platforms are often inconsistent in how they apply and enforce their policies, with non-English speaking countries often taking the brunt of most post takedowns.

Last year, in Iran, several hundred Instagram posts inciting violence against Iran’s supreme leader, Ali Khamenei, with the tags “Death to Khamenei” were taken down. However, activists protested the takedown of the chants, which are used all over Iran, and Facebook instituted a similar two-week Hate Speech permit to allow Iranians express themselves.

Several armed crises have occurred and are still occurring in the MENA region with wars and insurgencies abound in Ethiopia, Afghanistan and even Syria, where Russian military troops are ingrained. In all these cases, Meta has not relaxed its user policies.

So what constitutes a crisis for Meta and how consistent can it be in applying these policies elsewhere?

Russia’s moves

Russia’s suit against Meta is one of few actions between the two.

After Meta banned Russian-state media from running ads on Instagram and Facebook, Russia banned Facebook in return and an Instagram is starting today. It’s also on the verge of labelling Meta as an extremist group.

Meanwhile, the country hasn’t slowed its insurgency into Ukraine which is costing lives on both sides. Despite sanctions from all ends, Russia is pushing violently into Ukraine and casualties are piling up.

Over 500 Ukrainian citizens and 2,800 Ukrainian soldiers are dead, and death tolls for Russian soldiers are as high as 4,000.

strong>Zoom out: With the number of casualties, a few people believe that Meta’s policy change won’t make a difference as both countries are already at arms.

Hurdles like chargebacks often make the running of a global business difficult, because they cause frustrations for your customers. Fincra is here to help. With Fincra’s streamlined payment collection process you can provide a better payments experience for your customers while scaling your business to its fullest potential with simple API integration.

This is partner content.

TC INSIGHTS: INFORMAL RETAIL MEETS TECH

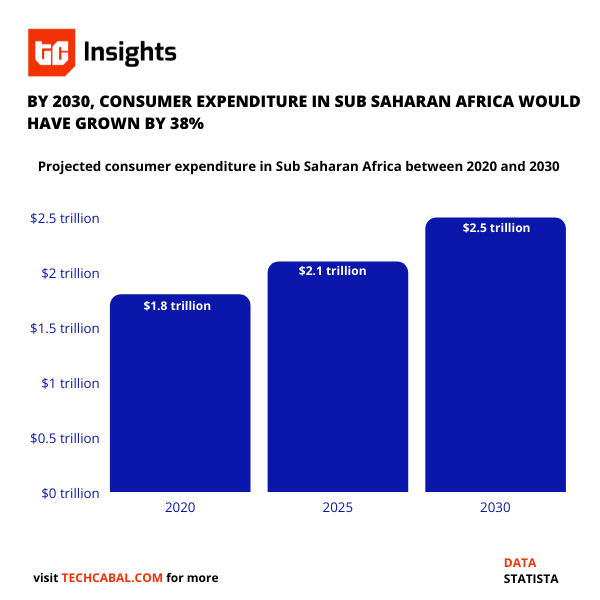

Africa is home to roughly 1.2 billion consumers today, a figure that is projected to increase to 1.7 billion by 2030. Consumer expenditure is equally growing. In the same vein, consumer expenditure is expected to reach $2.1 trillion by 2025 and $2.5 trillion by 2030. But the bulk of African consumers is mostly served by informal market players like owners of kiosks and small shops.

Unlike regions where household consumption is mostly measured in terms of formal retail markets, a huge chunk of retail spending in Africa still takes place in informal markets. According to the United Nations Economic Commission for Africa (UNECA), about 90% of transactions in Africa’s retail market occur through informal channels such as kiosks and small shops.

The popularity of informal kiosks and small shops among Africans is due to the ease at which they cater to the daily needs of people, their flexible credit options, as well as their low prices.

In spite of this huge potential, informal retailers are faced with challenges that slow business growth and affect service quality. For instance, they are unable to track sales data and gain insights into consumer spending patterns.

Retail-tech startups like Tradedepot and Marketforce are filling this gap. By leveraging technology to understand how and where a product is consumed, they will be able to develop specific product offerings to meet the needs of diverse population segments.

According to Christy Tawii, a Senior Research Analyst at Euromonitor International, “Development of diverse products and services that meet different socio-economic needs is essential to the growth of the region.”

Another example is creating loyalty programmes on the back of the enormous data they get from their users. Also, they must bring both virtual and physical worlds together to create an omnichannel experience for users. These experiences must be data-driven and represent the customer persona.

Modernising informal trade is key to unlocking economic welfare and improving the lives of retailers across Africa.

You can download all our reports here and watch videos from our events. Send your custom research requests here.

JOB OPPORTUNITIES

We’re hiring for a couple of roles at Big Cabal Media (BCM). Supercharge your career with us! There are a few other openings too.

- Big Cabal Media – Sales Associate, SEO Editor, Paid Media Manager – Lagos, Nigeria

- Zikoko – Copywriter – Nigeria (Flexible)

- Paystack – Product Specialist, Business Lead – Ghana

- Microsoft – Senior Product Marketing Manager, Senior Apps Consultant – Johannesburg, South Africa

- Seedstars – Product Manager, UI/UX Designer – Lagos, Nigeria

There are more jobs here. You can also submit any listings you have at bit.ly/tcxjobs.

What else we’re reading

- Solar Mamas: Meet the women bringing light to Sudan’s Nuba Mountains.

- Peace Ojemeh’s Haze Monkey finds a home in the $80 billion NFT industry.

- How billion-dollar caller ID app TrueCaller knows so much about you.

THE JOURNEY OF MULTIPLE FUNDING ROUNDS STARTS WITH A SINGLE SHIRT 👕

Look the part. Check out techcabal.com/shop to start your journey.