After co-founding and running Afrika Startup Lab—a non-profit that connects African founders with mentorship and training—for nearly 2 years, US-based entrepreneurs Boum III Jr and Anthony Miclet are familiar with many of the challenges founders and startups based on the continent face, chiefly among which is lack of access to capital.

African companies still endure a difficult time raising capital from external investors and, for many founders, the idea of bootstrapping is the only viable option. “At Afrika Startup Lab, we’ve worked with more than 800 entrepreneurs and realised that a lot of young African startups, despite being investable, lack access to much-needed capital to build,” Boum said in a recent interview TechCabal.

That doesn’t necessarily mean a lack of investor appetite for the continent. Africa’s startup funding landscape hit a record ∼$5 billion in 2021—a figure that’s on track to hit $7 billion this year as global VC giants like Tiger Global and SoftBank increasingly back African founders. But only a fraction of startups is able to attract funding from venture capital and private equity investors.

Angel investors have been crucial in filling the funding gap, especially for startups just starting out. They are mostly upwardly-mobile professionals and high net worth individuals (HNWIs) from across the world who often back startups through angel networks or syndicates.

But what if there was a way to broaden the pool of investors to include less affluent individuals (from across the world) but with disposable income and willingness to invest in investable opportunities in Africa? This was the question on the minds of Boum and Miclet as they sought to address the financing challenge for African startups.

“In the US and Europe, where up to half of the population invests in financial instruments, early successes in Africa’s startup landscape have spurred further interest from investors looking to diversify their portfolio,” Miclet told TechCabal on a call. “But most are oblivious to lucrative deals and lack requisite information and resources to invest safely. In cases where these are available, the size of their cheques might be too small to participate in funding rounds.”

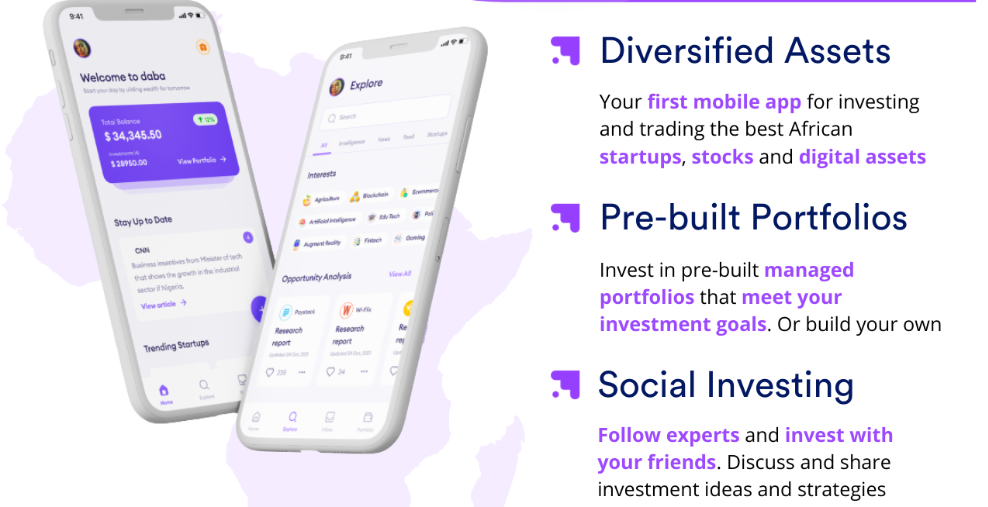

Their efforts to address these bottlenecks led to the creation of daba—a platform that allows individual investors across the world to discover and invest in some of Africa’s most promising companies, through an app, and with as little as $50.

Currently in beta, daba offers investors a single, consolidated platform with the tools to invest in opportunities vetted and approved by the company’s in-house investment team. At the other end of the spectrum, capital seekers (from early-stage to growth-stage startups) can raise funding, build community, and secure alternative financing options, all through the platform.

“We’ve identified a steep chasm between the financing needs of African startups and potential investors looking for promising investment opportunities,” co-founder and CEO Boum said. “Our platform serves as an infrastructure to bridge this gap, making it relatively easier for African companies to access capital and investors to find these companies.”

Boum, an MBA graduate from the University of Chicago Booth School of Business, has a strong background in the financing space having worked as a fintech software engineer for 5 years at eVestment, a Nasdaq unit that provides institutional investment data, analytics and market intelligence covering public and private markets.

He’s also familiar with building a successful venture after growing his first company, Mbo’Wam (a travel lodging platform that offers business travelers hotel-style stays in apartment homes and private residences), to $1 million in annual recurring revenue in under 3 years.

Anthony meanwhile brings strong experience in product marketing and management and is daba’s product lead. His experience spans roles across Salvatore Ferragamo and Coca-Cola’s e-commerce division for 4 years, in addition to holding a product management role at a Techstars-backed SaaS startup.

Attracting foreign capital to Africa’s public markets

According to the co-founders, the ultimate vision for daba is to become an end-to-end solution for investors interested in Africa, providing resources from pre-investment intelligence, trade execution, capital deployment, to portfolio tracking and management across multiple asset classes and securities, in both private and public markets, such as stock exchanges.

“After spending several months researching, we realised that the problem of retail investor participation in Africa also exists in public markets,” Boum said. “Today, the class of investors that dominate both private and public markets are institutional with minimal individual representation.” Starting out, the company will however focus on private companies, specifically tech startups looking to raise pre-seed to Series A rounds.

daba’s goal of empowering retail investors to put money into companies listed on African stock exchanges is a marked reversal from what investment apps like Bamboo, Chaka, and Rise enable. It’s a noble goal but also not as easy as creating new technology.

Wooing foreign capital to Africa is not an easy task. Among other things, the continent’s 29 stock exchanges are small and often dominated by a handful of large corporations. In many cases, the general public does not have confidence in the integrity of stock exchanges. And the policy changes like stock exchange consolidation that can unlock African public markets for retail require significant political will.

At the same time, diaspora remittance to Africa in 2021 increased by 6.2% to $45 billion, per World Bank data. If remittances alone were an exchange it would be the 6th largest capitalised bourse in Africa.

Given the sheer size of remittance flows, Africans in the diaspora are part of the group of potential investors daba is targeting, in order to enable startups tap into this diaspora wealth through its platform.

“The goal is to democratise investing in public and private African capital markets, knowing that the current state of investing is disjointed and intimidating for many interested and able investors,” Boum said. “With $50, anyone can invest through daba.”

According to the company, daba currently has a growing waitlist of about 500 users who have pledged to invest over $2.3 million within 12 months of the launch of the platform. The company also recently closed its first successful investment in a pre-seed African startup. It plans to go live initially in 6 African countries: South Africa, Kenya, Nigeria, Cote d’Ivoire, Senegal, and Ghana, where it has partnered with licensed stockbrokers to enable investing in public markets.

Whether daba succeeds will depend on how well it can craft and lean into a narrative about owning a part of Africa’s prosperity.

Platform-led angel investing on the rise

Across Africa, a number of startups like daba have emerged in recent years with new approaches to organised angel investing and aiming to change the status quo of startup financing and venture capital on the continent. While similar, in the sense that they’re platform-based, players in the space don’t operate a monolithic model.

Lagos-based GetEquity, for instance, allows companies digitise their assets via tokens and market themselves to angel investors, syndicates, and institutional investors, who can buy equity in a listed startup for as little as $10. Raise, an all-in-one platform in Kenya, helps African startups simplify the fundraising process and close deals faster for a “third of the cost”, as well as manage equity and legal compliance.

Regardless of the model, these platforms enable underfunded entrepreneurs to avoid the friction associated with conventional methods of fundraising from venture capital firms, by connecting and networking with potential angel investors directly.

daba differs in terms of the scope of investors it is targeting and asset classes available on its platform, which cuts across private and public markets. “We’re bringing it all in one application,” Boum said. “You can access private market securities, tech startups to begin with, as well as public market securities. That diversification makes the investment experience holistic for the investor.”

It’s easy to see why foreign investor interest in Africa is on the rise. The continent is home to some of the world’s fastest-growing economies and in recent times, African stock exchanges have outperformed their global peers, a clear indication that there is an opportunity to make superior returns.

But beyond Africa, Boum envisions a future where daba becomes the financial rails for investors to easily bet on promising opportunities in emerging markets across other continents.

“Maybe one day. It’s just far too early to say,” he said, with a slight chuckle. “Right now, we are focused on Africa, which already covers 54 countries, [but] we believe that if we’re able to facilitate investments in Africa, we can do so across other emerging markets as well.”

If you enjoyed reading this article, please share it in your WhatsApp groups and Telegram channels.