Good morning ☀️

In Kenya, telecoms company Airtel is battling regulators to dodge a probe of alleged vendor bullying. The regulator—Competition Authority of Kenya—is bent on investigating and taking action against the telco over alleged abuse of buyer power.

Anyways, while corporate giants like Airtel grapple with power dynamics, countless individuals face the fallout of industry shifts. If you’ve been caught in the recent tech layoff wave, please share your experience in our survey.

Lesotho’s central bank suffers cyberattack

On December 11, 2023, the Central Bank of Lesotho discovered that a cybersecurity incident had affected its system. The apex bank has restored transfers, but it advised customers to expect delays as the processing of payments is done manually.

What attack? While the nature of the attack was not disclosed, the attack led to several outages and affected the country’s National Payments System, which facilitates inter-bank transactions.

Zoom out: According to local media, there are concerns that the current wave of attacks might affect Lesotho’s exchange rate against the rand. Lesotho’s incident is not a standalone incident in southern Africa. The Development Bank of Southern Africa confirmed in June that it was hit by ransomware.

Access payments with Moniepoint

Moniepoint has made it simple for your business to access payments while providing access to credit and other business tools. Open an account today here.

Chipper Cash may be profitable in 2024

Chipper Cash, a prominent African fintech startup once grappling with heavy losses, is now set to achieve profitability by early 2024, according to a former executive who claimed to have spearheaded the company’s dramatic turnaround.

Turn around from what? In a LinkedIn post yesterday, Zain Hirani announced his departure from Chipper Cash after a year-long tenure as the director of revenue strategy. He says that upon joining in 2022, the company which was once valued at $2 billion had burned through $250 million of the over $300 million funding it raised. The then-unicorn was also struggling with unsustainable losses driven by a “growth at all costs” strategy. Around the same time, two of its major investors, FTX and SVB, collapsed.

Things have changed now: Per Hirani’s post, the company’s contribution margin turned positive after six months of review of product economics and commercial contracts, with better financial discipline and laying off over 50% of its workforce. Its most recent layoff was announced a little over a week ago. The company also slashed the salaries of its remaining US and UK employees.

How does Chipper Cash make money? The company operates a cross-border payments service that reportedly enables five million customers across Africa, the UK, and the US to send and receive money from eight countries, including Nigeria (Africa’s biggest economy by population and GDP) and South Africa. It runs a virtual card business in partnership with Visa and allows users to make peer-to-peer transactions without charging a commission upfront. The fintech makes revenue from the exchange rate arbitrage involved in international fund transfers. In addition to global fund transfers, the service helps merchants accept payments online. Two months ago Chipper announced the launch of Chipper ID, an AI-driven verification and onboarding tool built specifically for the African continent.

Introducing: BookingPress integration

BookingPress helps you manage your appointment bookings end-to-end on WordPress. Get paid online via Paystack when you use BookingPress. Learn more →

Is Pezesha’s liquidation suit premature?

Tesh Mbaabu, CEO of a Kenyan B2B e-commerce startup,MarketForce, has questioned the approach Pezesha—a startup that offers business loans-as-a-service—takes to resolve a debt crisis.

However, in a petition filed in September 2023, Pezesha asked a Kenyan court to liquidate Marketforce’s assets over an unpaid debt. Pezesha claims that Marketforce owes them a lot of money but hasn’t shared specific information about why the debt exists or the exact amount they’re trying to get back from Marketforce.

Although Pezesha did not explicitly state in its legal action that it aimed to collect outstanding debts arising from the 2021 inventory financing agreement with Marketforce, Mbaabu hinted that this might be the case.

Zoom out: Marketforce puzzle is not a first. Twiga, the Kenyan e-commerce startup, was sued by cloud service vendor Incentro, which asked a court to declare it bankrupt and force Twiga to repay its debts. The dispute is still being discussed privately between the two firms. Since its launch, Marketforce has raised $42.5 million in funding, the most recent being a $40 million Series A funding round led by V8 Capital Partners, a venture capital firm based in London and Lagos.

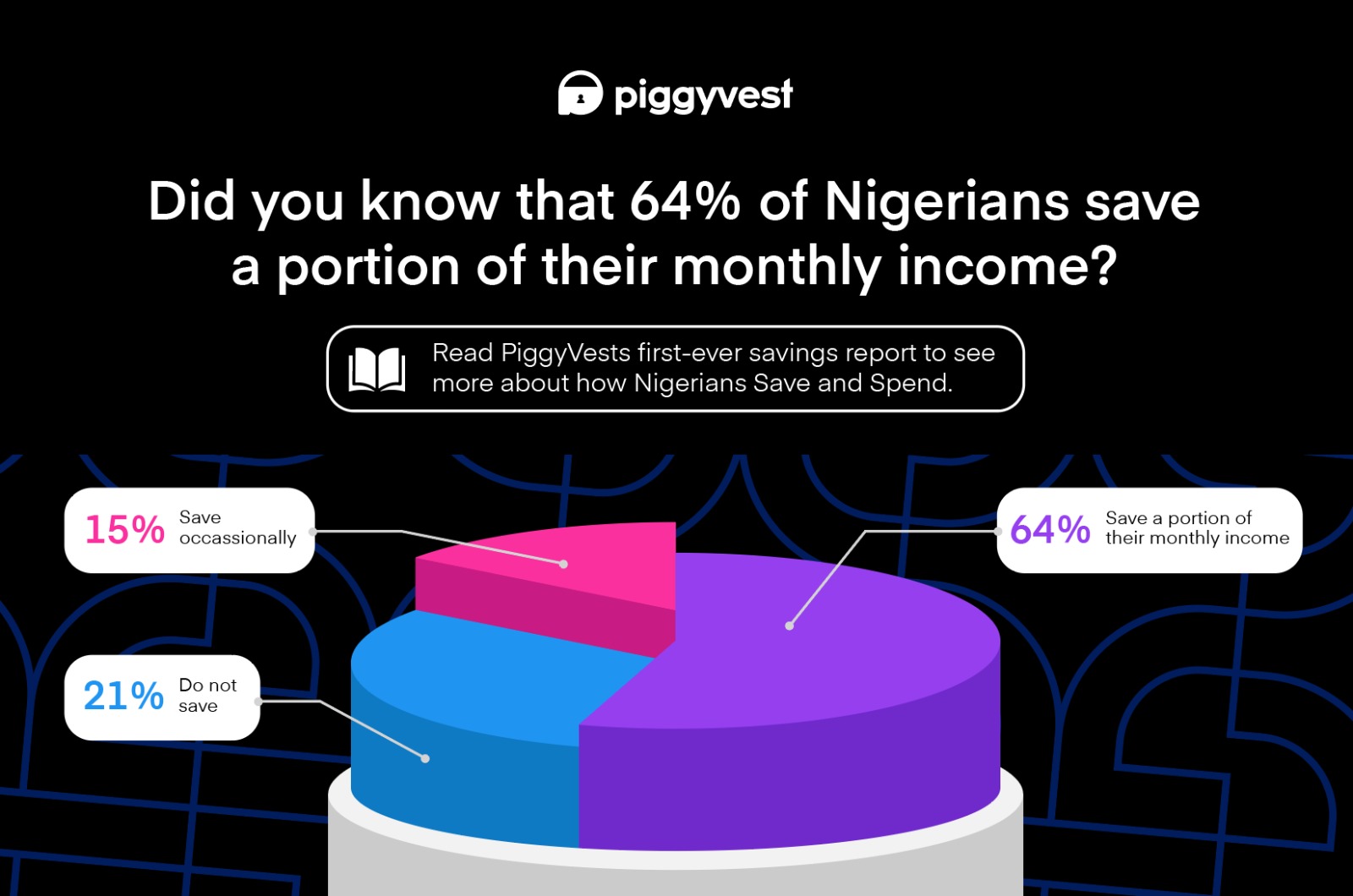

How do Nigerians save and spend?

Did you know that 64% of Nigerians save a portion of their monthly income? Read PiggyVest’s first-ever savings report to see more about how Nigerians save and spend here.

Lusaka’s leading ride-hailing apps facing scrutiny

Drivers on Lusaka’s most popular leading ride-hailing platforms Yango and GO aren’t having a jolly ride at work. They do not like that the platforms prioritise customer acquisition over driver welfare. The drivers have previously, in March and May, protested against the platforms’ way of doing business in the Zambian city. During the May protests, some drivers impounded the cars of drivers who decided not to join the protests.

What is Yango and GO doing wrong? These platforms are locked in a price war, and guess who’s getting squeezed into the back seat? Yep, the drivers. The discounts and lower prices the platforms keep throwing to get more users are driving down the drivers’ earnings. Their expenses on fuel, car repairs, and talk time for contacting customers are increasing.

Some drivers have found a way out: Aside from protests, some drivers have resorted to only picking up customers who request cash trips so they can ask them to pay more. This is against the app’s terms and conditions of use, but they do it anyway. Some drivers say that the Yango in-app map is hard to use and elongates travel time unnecessarily. Additionally, there are always some unexplained charges and deductions from their earnings. Some Yango drivers say that they hardly get rides despite having high ratings and “priority points”. When they do, they sometimes suffer harassment from riders.

Sounds familiar? Uber does not operate in Zambia and Bolt is not as popular in the country. But in countries like Kenya, Nigeria, and South Africa where both operate, drivers occasionally make similar complaints. They have also resorted to similar means as the Zambians have to improve their income from the platforms.

Starlink launches in Eswatini

Starlink, Elon Musk’s satellite internet service provider has officially launched in Eswatini.

Starlink already beams across Kenya, Mozambique, Rwanda, Mauritius, Sierra Leone, Zambia, and Nigeria. The service is awaiting regulatory nod In Zimbabwe and Botswana where its application for an operation licence is still being vetted. Starlink’s operation went through swiftly in Eswatini, getting a licence in June after applying in March.

A hefty price tag: Over half the 1.2 million people in Eswatini live on less than $3.65 a day, making Starlink’s cost a tough pill to swallow. Starlink’s most common “Residential” package costs R1,070 (~$ 58) per month. Hardware and shipping will cost customers another R12,450 (~ $670).

Stuck in regulatory purgatory: Despite being its biggest potential market, South Africa has banned Starlink due to ownership requirements, with the company baulking at the 30% quota for disadvantaged groups.

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $42,232 |

– 0.93% |

+ 12.70% |

|

| $2,175 |

– 1.78% |

+ 8.05% |

|

|

$252.13 |

+ 4.64% |

+ 2.22% |

|

| $1.00 |

+ 0.02% |

+ 0.01% |

* Data as of 00:50 AM WAT, December 20, 2023.

Effortlessly make global settlements in over 30 currencies across 120+ countries spanning four continents, delivering cost-effective and reliable solutions to your clients, suppliers, and customers. Get started today.

- Product Manager (Remote) @Yassir

- Senior Associate, Chargeback & Refunds (Global Operations) @Flutterwave

- Alternative Payment Method Relationship Manager with a Security Background (Lagos) @Unlimit

- Head of Payments (Remote First) (Hybrid) @Duplo

- Finance Director, Nigeria @VISA

- Compliance Analyst @Lemfi

- Product Manager @Seerbit

- Key Account Associate – Merchant Acquiring – Abuja @Palmpay

What else is happening in tech?

Written and edited by –

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Weekender: weekly roundup of the most important tech news out of Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 12 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

saldibenetton ynotborse ovyeshop maisenzashop diegodallapalmaoutlet adidas boost 43 harmonte-blaine ovyeshop wmns air 1 mid loevenichhutkaufen ynotborse chilloutshut wmns air 1 mid negozitata harmontblainescarpe