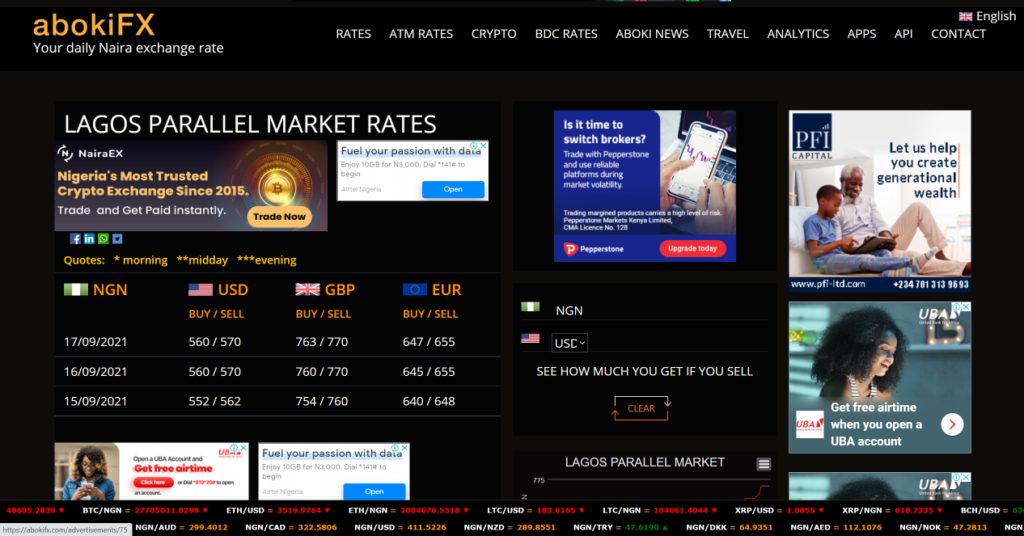

abokiFX, a popular mobile and web-based platform that collates the black market foreign exchange rates in Nigeria, on Friday announced it will temporarily suspend the publishing of rates on all its platforms, hours after receiving threats from the Central Bank of Nigeria (CBN).

The apex bank had said it would shut down the platform, which Governor Godwin Emefiele described as “illegal and criminal” and accused of carrying out an “illegal activity that undermines the economy”.

After the Monetary Policy Committee’s two-day meeting in Abuja, Emefiele confirmed that the apex bank was also planning to prosecute abokiFX’s supposed owner, Olusegun Adedotun Oniwinde, for “illegal forex trading” and “economic sabotage”.

“I have given instructions to our experts to go after his website and let it be clear that we will go after him because we can’t allow this to continue,” Emefiele said, adding that the CBN does not recognize any foreign exchange market window apart from the Investors and Exporters (I&E) window.

Why Nigeria has different exchange rates

Nigeria is Africa’s largest producer of oil, a commodity that brings in more than 90% of the country’s foreign exchange earnings. Between 2014 to 2016, a plunge in global oil prices caused a dollar crunch that resulted in an economic recession.

But rather than an outright devaluation of the naira, the CBN adopted a multiple exchange-rate regime. This involved keeping a stronger rate pegged to the U.S. dollar for official transactions and a weaker floating rate for investors and exporters, known as the NAFEX window.

Other rates were introduced for travelers and small and medium-sized businesses (SMBs) while there’s also the parallel or black market, where foreign currencies are traded unofficially and the naira is often valued less than the NAFEX rate.

A historic plunge in oil prices triggered by the Covid-19 pandemic last year caused a more severe scarcity of hard currency in Nigeria. The CBN was forced to devalue the naira twice last year, amid other measures meant to stabilise the exchange rate such as limiting forex deposits and withdrawals over the counter and banning the sale of forex to exchange bureaus.

In March, the apex bank also replaced the exchange rate at the official window, set at ₦379/$1, with the NAFEX rate of ₦410.25/$1, as part of efforts to ditch the multiple exchange rate system that’s been said to distort the market and frustrate foreign investors, in favor of a single-rate system. That left Nigeria with only two rates – the NAFEX rate and the parallel market rate – from almost five different rates as of early 2020.

Where abokiFX comes in

Before abokiFX, Nigerians wanting to change currencies in the unofficial black/parallel market could only obtain information on rates manually, such as through phone calls to money changers.

However, the platform, which was launched in 2014 has gained popularity as a go-to source for information on the value of the naira against the major foreign currencies in the black market. It is used by market operators for trading and news organisations for reporting.

In recent weeks, and particularly after the CBN stopped forex sales to Bureau De Change (BDC) operators a month ago, the value of the naira has plummeted sharply, with the gap further widening between the parallel and NAFEX rates.

Before the ban, the local unit traded at around ₦520/$1 but fell to ₦570/$1 on Friday. A day before, the naira recorded its biggest single-day plunge in the parallel market in several months, a ₦8.00 or 1.42% decline from ₦562/$1 on Wednesday to ₦570/$1, per abokiFX data.

Meanwhile, data on the FMDQ securities exchange window, where forex is traded officially, showed that naira closed at ₦412.88/$1 on Friday. Currency speculators profit from this difference between the black market and official rates through round-tripping and other forms of currency manipulation practices that negatively affect the value of the local currency.

Allegations of economic sabotage

According to the CBN Governor, Oniwinde, who is based in the United Kingdom, publishes arbitrary rates without contacting BDCs and uses his website for forex manipulations and speculations, making profits from the significant disparity in rates quoted on abokiFX and the official exchange rate.

Emefiele added that the apex bank had been studying the activities of the platform in the last two years. “There was a time we asked our colleagues to call the abokiFX to ask how he conducts the rates.”

“The CBN act section 2, does make it clear that only the Central Bank can determine the value of the naira, and yet a single individual living in England continues to manipulate the exchange rate and make a huge profit which he withdraws through an ATM in London.

“It is economic sabotage and we will pursue him, wherever he is, we will report him to international security agencies, we will track him, Mr. Oniwinde, we will find you, because we cannot allow you to continue to conduct an illegal activity that kills our economy,” Emefiele said.

The CBN head also alleged that Oniwinde was an illegal forex dealer with over 20 bank accounts in eight banks that are filled with money from speculative activities and he’s sold “tens of millions of forex” to several Nigerian companies, violating the country’s foreign exchange laws.

abokiFX debunks claims

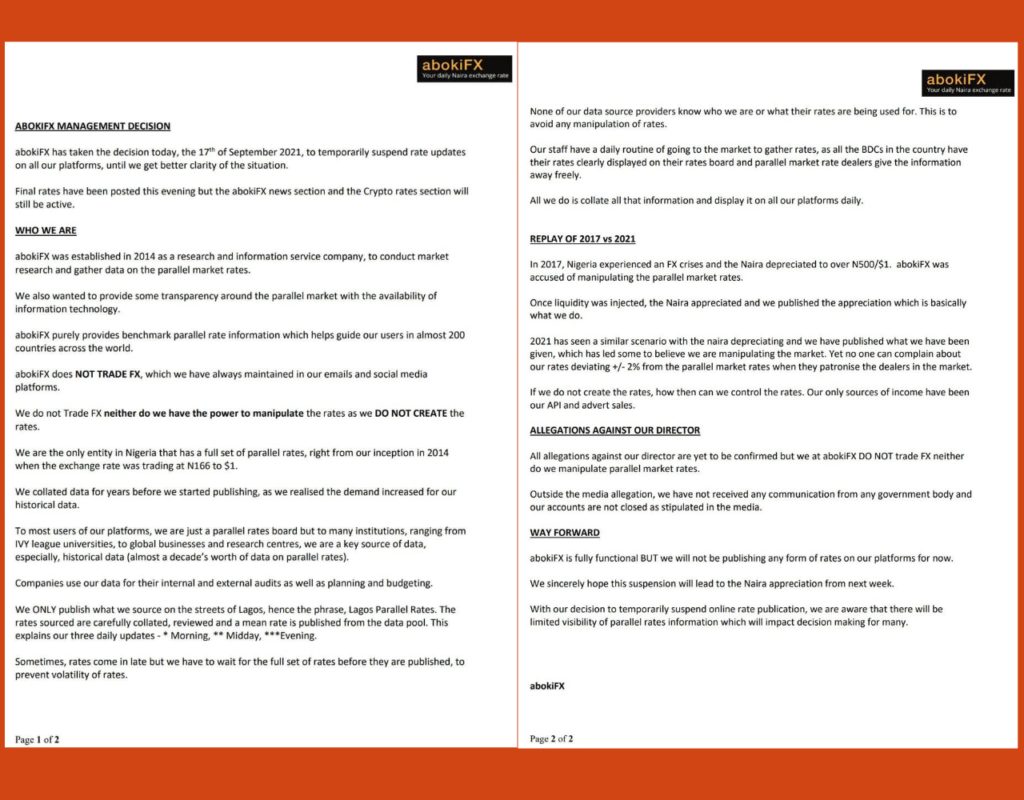

abokiFX in a statement released on Friday debunked the CBN’s claims and said all allegations towards its director were not confirmed.

“All allegations against our director are yet to be confirmed but we at abokiFX DO NOT trade FX nor do we manipulate parallel market rates,” the statement reads. “Outside the media allegation, we have not received any communication from any government body and our accounts are not closed as stipulated in the media.”

The company has, however, temporarily suspended rate updates on all its platforms to “get better clarity of the situation”, adding that it “sincerely hopes the suspension will lead to the Naira appreciation from next week.”

“Final rates have been posted this evening but the abokiFX news section and the crypto rates section will still be active,” the statement adds. “With our decision to temporarily suspend online rates publication, we are aware that there will be limited visibility of parallel rates information which will impact decision making for many.”

If you enjoyed reading this article, please share it in your WhatsApp groups and Telegram channels.