“Mummy, give me your phone,” says a 10-year-old boy at a restaurant in Lagos, Nigeria. His mother reaches into her bag and hands him her smartphone. “Don’t play any video,” she warns, “I don’t have enough data.”

Once the phone is in his hand, the boy sits quietly and goes straight on to disobey his mother. Unconcerned with the cost of internet data, he opens the YouTube app to play the comedy skits from Mark Angel Comedy, a popular comic channel.

“Give me my phone,” his mother screams after hearing the sound from her phone.

With the internet natural to them, Nigeria’s young population could fuel the growth of the internet for decades to come; consuming and adopting internet services at a significant pace.

Internet adoption in Nigeria has grown quickly over the last decade. But the next ten years could see internet adoption explode thanks to a combination of a rising population of digital natives and deepening broadband penetration.

Digital native is a term used to describe a person who grew up in the digital era. In Nigeria, the start of the digital era parallels the liberalisation of the country’s telecom industry in 2001.

The Nigerian telecom industry was a state-led enterprise during the second half of the 20th century. Market liberalisation started in 2000, leading to the auction of 2G licences to four private companies in 2001.

Since then the industry has boomed. Mobile telephony penetration has deepened. During this 2G era, the number of mobile lines jumped from zero in 1999 to 9.2 million by 2004, according to an NCC presentation [PDF]. By March 2020, the number of mobile subscribers topped 189 million. A massive leap from 1999.

Nigeria’s digital natives were born and grew up to this fast-paced telecom evolution. The cost of SIM cards crashed from ₦15,000 ($38.65) in 2001 to as low as ₦50 ($0.13) in 2020. The price of mobile phones dropped in relative terms over the last two decades. Today, some smartphones are sold for less than ₦10,000, a low amount that is even smaller when adjusted for inflation from 20 years ago.

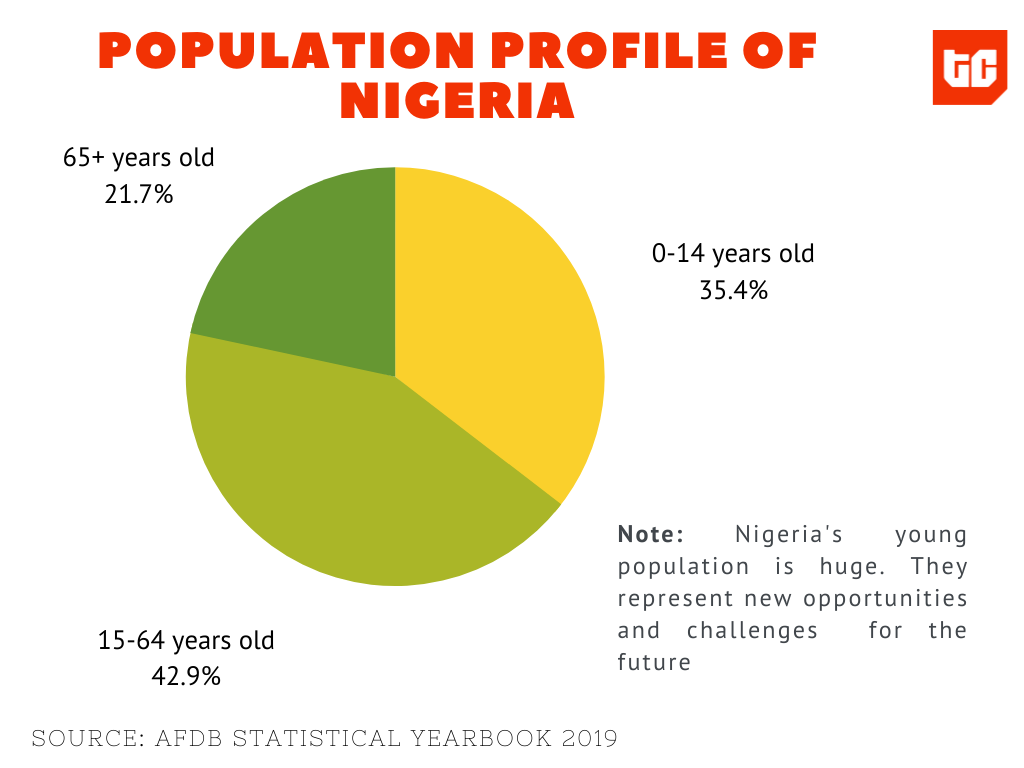

Digital natives in Nigeria are younger than 20 years old, using the telecom industry as the benchmark. According to the African Development Bank (AfDB) 2019 Statistical Yearbook, at least 82 million Nigerians are younger than 15 years old. Over the next ten years, a significant number of this age group will become adults and join the country’s labour force.

As they grow, digital natives will consume more internet and technology services. For telecom companies, the pandemic-related lockdown in Nigeria captured a glimpse of what the future could look like. According to reports from MTN and Airtel in Nigeria, data consumption is rising fast.

The trend towards online voice and video services is already being accelerated by millennials, Nigeria’s population between the ages of 20 and 35. Digital natives will fuel this even more.

The internet is natural to them and they may not know a world with it. As internet penetration deepens, they are more likely to try new apps, shop online, switch from regular calls to online video and online voice calls, watch online video than older Nigerians. For the next two decades, digital natives will fuel the growth of the internet in Nigeria.

This could create new opportunities for many services and businesses. The urgency for simple solutions is already fanning the growth of fintech products like payments (PayStack), savings (PiggyVest) and investment (CowryWise).

Interestingly this growth has happened despite the fact that broadband penetration is relatively low in Nigeria. According to NCC statistics, only 44% or 76 million mobile subscribers are on 3G and 4G broadband. The rest of the subscriber base (112 million) is stuck on 2G.

Over the last four years, telecom companies have resolved to change this. With some support from the government, they have intensified broadband development, marketing and developing their 3G/4G services significantly.

This could open more opportunities for different types of online services.

Nigeria’s younger population struggle with low income

However, a significant setback is, Nigeria is not creating wealth fast enough and this could significantly affect income levels for digital natives.

Between 2015 and 2018, just 1.64 million new jobs were created, taking the total employed labour force to 69.5 million. Underemployment and unemployment are high, a Nigerian Bureau of Statistics (NBS) report shows.

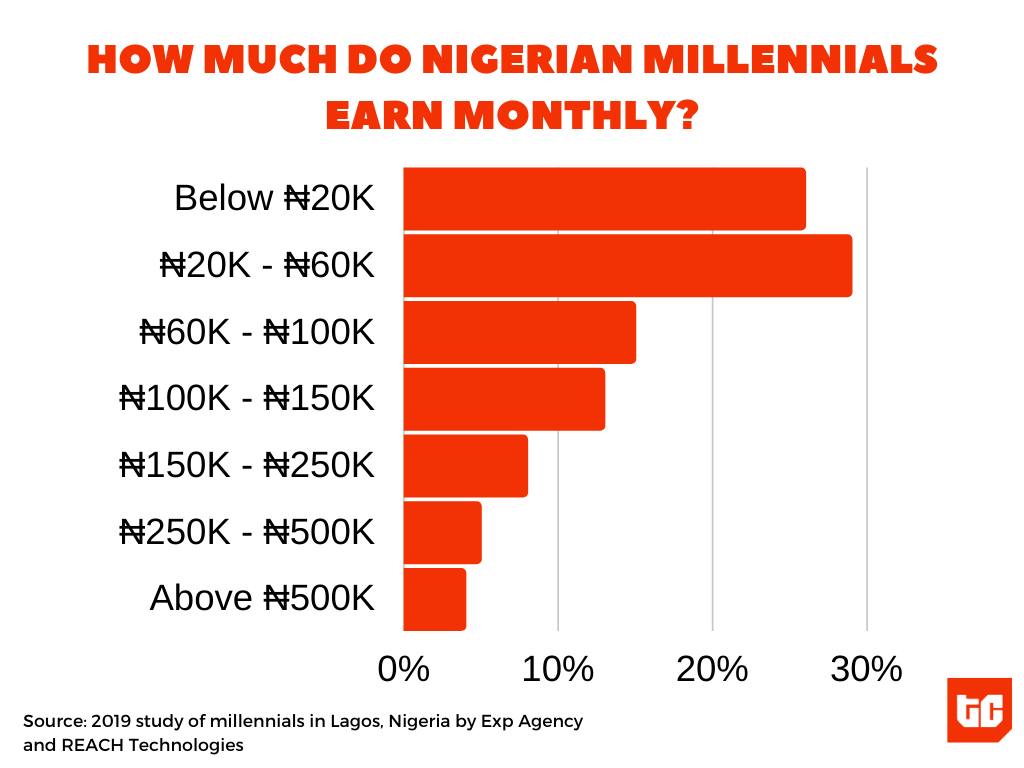

A 2019 study by Exp Agency and REACH Technologies revealed 70% of millennials in Lagos earn less than ₦100,000 ($257.7) monthly, with 55% of them earning less than ₦60,000 ($154.6) a month. Digital natives may find it tough as the Nigerian economy continues to grow slowly and unsustainably driven by the commodities industry, mostly oil.

The trend of rising internet adoption in an environment with low income could widen the digital divide in Nigeria, excluding a significant number of people from benefiting from the internet and digital services like e-commerce, eLearning, among many others.