The BackEnd explores the product development process in African tech. We take you into the minds of those who conceived, designed and built the product; highlighting product uniqueness, user behaviour assumptions and challenges during the product cycle.

—

Evolve Credit wants to be an authoritative loan and financial products marketplace for Africa, starting with Nigeria.

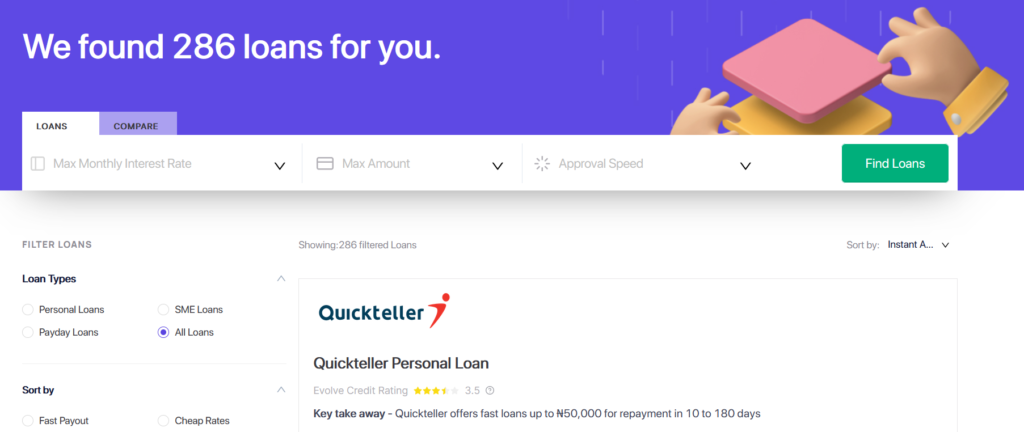

Want to find a loan but don’t know which company to apply to? Evolve is promising to show all you need to make an informed decision.The web app offers price comparison features, and unmasks terms and conditions for at least 286 personal and SME loan offers.

A quick glance shows offers from Carbon, GT Bank, Quickteller, ALAT and Fairmoney. Then, there are a host of brick-and-mortar microfinance banks and brands that may not show up on Google.

It is digital lending kindergarten for the uninitiated, an aggregator for the industry and possible source of original credit insights for researchers and policymakers.

At the bottom of their web pages, Evolve state clearly that they do not offer loans:

“Information on this website is for educational purposes. Our financial and comparison tools are completely free of charge. The presented information does not constitute an offer.”

If that’s all Evolve does, one might wonder what the big deal is then. Reviewing information about loan products in the marketplace and comparing options based on price, etc doesn’t come across as a lot of “fintech-ing” per se.

This inquiry is all the more necessary considering recent investments in the six-month-old startup by Future Africa, Samurai Incubate, Microtraction, and Ingressive Capital.

Why does Evolve Credit exist?

User personalization and sector regulation

“The big vision is to make the financial products marketplace more inclusive, accessible and transparent for individuals and small businesses,” Akan Nelson, the startup’s co-founder and CEO, says to TechCabal.

These are not foreign concepts to any follower of fintech in Africa. To the point of where it now commands an eye roll, “inclusion” has become a dependable way of fitting into the wave without having to explain clearly what one does.

So what does Nelson mean by deploying this nearly over-used word?

“Most business owners and individuals do not have enough information to select the best financial products,” he says.

By which he means that if you asked the average small business owner selling at a mall in Surulere, Lagos, where they could find a ₦500,000 (~$1,075) loan at a rate convenient for their type of business and income, it is more likely than not that they would not know.

While there is no data to back this, it is not beyond reason. Credit culture is weak in Nigeria, especially among middle-to-lower income households. Nigerian banks are increasing the loans they provide to the economy but they continue to favour established industries like oil and gas, and manufacturing.

Banks are the bastions of credit in every country, and Nigeria is no exception. But Nigeria’s top banks, the so-called FUGAZ (First, UBA, GT, Access and Zenith), remain very risk averse towards entertaining credit requests from people they cannot track with data; that is, people they don’t know.

Hundreds of digital-first startups have risen to fill this void, creating alternative assessment methods to offer credit. The large number of players makes for a competitive landscape that should, in theory, create a market of quality products suitable to consumers.

But the ease of access has come with accusations of predatory lending and privacy intrusion, to name just two. The central bank in Kenya has proposed a law to clamp down on digital payday lenders.

Through this lens of the defects that have come up in the African digital lending space, we see what Evolve Credit could be: by providing information on loan providers, they regulate the industry even without the ability to mete out punishments on offenders.

“When people don’t understand what their options are, they’ll take cash from wherever they can get it. It makes people prone to getting tricked into all sorts of schemes,” Nelson says.

But this market regulation role is secondary. For Nelson, Evolve Credit’s aggregation of options fulfils its core message of inclusion primarily through the promise of personalization.

Based on the lack of money transfer features associated with payments, lending, savings or investment platforms, Evolve Credit doesn’t quite rank as a fintech.

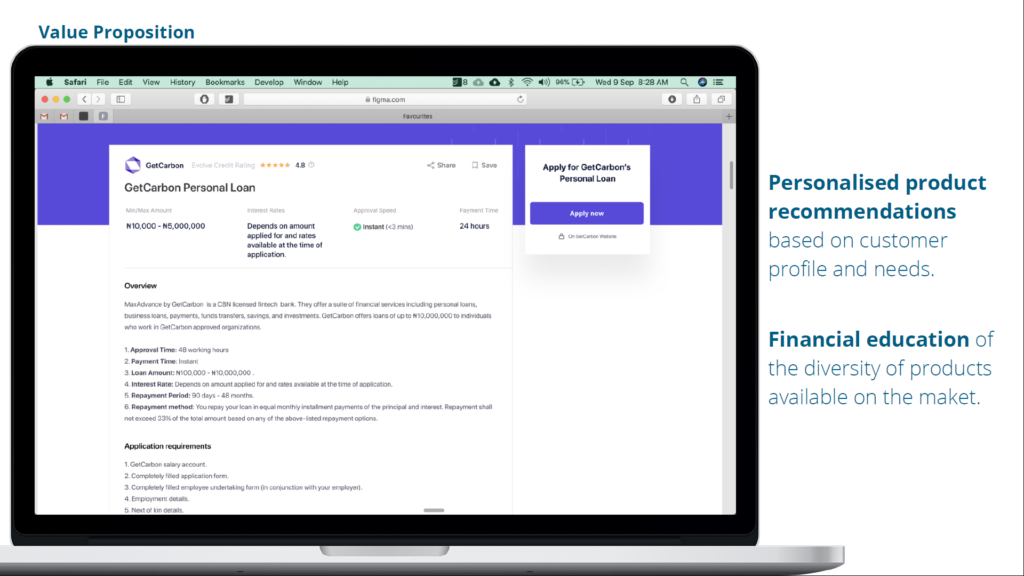

But the platform takes its place in the industry by combining financial know-how and technology to help users and providers make better credit decisions. Users sign up for free by providing some personal information and receive recommendations based on their profile for which loans they can apply to. The application tab on each product takes the user to the provider’s website.

Evolve Credit’s editors assign reviews and ratings to each lender on the platform to guide user expectations. This editorial function, Nelson assures, is unbiased.

Visibility and portfolio management for lenders

The third problem Evolve hopes to solve in digital lending is to increase the visibility of the pool of lenders. While there are over 1,000 licensed lenders in Nigeria, the vast majority are not online, Nelson says.

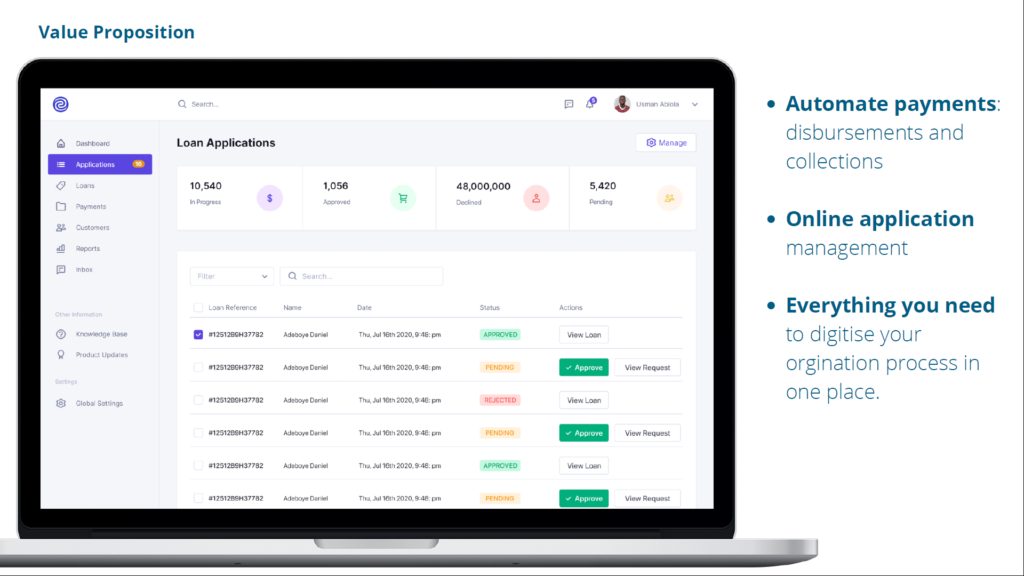

“We provide technology that enables lenders who do not yet have a high level of technological sophistication to completely digitize their process.”

Evolve provides these lenders with a backend software to build web forms, receive loan applications, manage portfolio of loans, and automate disbursements and collection. The pitch to these companies is to help them operate “completely remote and completely online,” Nelson says.

It’s not obvious that all lenders would want to be online or easily discoverable. Anyone offering a predatory scheme would likely shun Evolve’s invitation because it will draw unwanted scrutiny.

However, the interest of a rural small scale provider that is genuine might be piqued. Lenders of all sizes could find value in using Evolve as an inlet for loan requests that fit their profile, as against getting somewhat unrealistic and even flimsy applications.

Evolve’s plan for attracting lenders to subscribe to this backend requires a massive adoption of the frontend by consumers. As of September, Nelson says over 5,000 loan applications have been started and that they have over 15,000 registered users. He says they hope to hit 1 million users by December 2021.

As you can see, there are no metrics on the number of loans disbursed. So is Evolve Credit a fintech or media business?

The distinction is noteworthy but it’ll be moot if they ultimately provide the value their investors are betting on: growing a fair and trustworthy credit market in Africa, beginning with Nigeria.