IN PARTNERSHIP WITH

Good morning ☀️ ️

Q: What do computers eat for a snack?

A: Microchips 😉

In today’s edition:

- Quick Fire 🔥

- The Backend: Lemonade Finance

- Gozem’s expansion

- Paystack’s expansion

- TC Insights

Quick Fire 🔥 with Emeka Ajene

Explain your job to a five-year-old

I help people do a bunch of everyday activities (like moving around their cities) more effectively using technology.

What’s the first career you dreamed of having as a kid?

I remember dreaming about being a physicist early on. I was really captivated by cosmology and the universe growing up, and in many ways, I still am.

What’s something you wish you knew earlier in career/life?

Be the river, not the boat.

What’s the best advice you’ve ever received in your career?

Always be learning — and if you’re no longer learning, do something else. Take time to appreciate and enjoy every stage of the journey — you can’t control everything, but you can control how you react. Grow where you’re planted — take advantage of your unique circumstances, background, and personal expertise to make a unique impact.

What are you reading currently?

Influence by Robert Cialdini — it’s about the principles and psychology behind persuasion and is particularly relevant to marketing & sales.

What’s the oddest job you’ve ever done?

I once parked cars professionally as a valet outside the (former) Ritz-Carlton hotel in Boston.

A genie gives you one wish for the African tech ecosystem, what would yours be?

High-quality infrastructure — from digital infrastructure like internet connectivity & affordability to physical infrastructure like road networks & power grids to knowledge infrastructure like world-class educational institutions and beyond.

Increase your online sales with a Paystack Storefront – a free, beautiful seller page that helps you bring creative ideas to life.

🏾 Learn more at paystack.com/storefront

Sending money out of Africa is a chore – Lemonade Finance wants to make it sweet

Before becoming Director of Operations at ORide in 2019, Ridwan Olalere had been around Nigeria’s startup scene for a few years, taking note of big problems.

He was the fourth senior engineer hired during Flutterwave’s very early 2016 days. It was a great perch for gaining insight into Africa’s untapped e-payments landscape.

In October 2020, Olalere took the leap from operator to founder. He left Uber as a Country Manager for Nigeria to start Lemonade Finance, “a borderless money app for Africans.”

But why Lemonade and why now? Why does Africa need another ‘borderless’ money app in 2021?

After a long break, Alex returns with a new edition of The Backend, a column that explores how tech products are built in Africa.

Gozem’s ride-hailing service goes live in Gabon

Gozem launched its ride-hailing service in Gabon this week.

Founded in 2018 by Emeka Ajene and Raphael Dana, Gozem operates an app that offers transportation, logistics, e-commerce and financial services in primarily francophone African countries.

Until the rollout in Gabon, Gozem was only available in cities across Togo and Benin, offering motorcycle taxis, tricycle taxis, and delivery of groceries, gas bottles, and meals.

The company says it has more than 500,000 registered users who have completed more than 2.5 million trips since inception.

The big picture: Gozem is aiming to be the super app for Africa. It is modelled after the success of Gojek and WeChat in Southeast Asia and China respectively. While it is only one of many super app candidates in Africa, geographic expansion is a signal of strong intent.

Taking a closer look: Gabon will be Gozem’s first operation outside of West Africa. The Central African country’s population is under 2.5 million with almost 75% under the age of 30. One point of curiosity in this expansion is that Gabon is a smaller country by population compared to Togo (~8 million) and Benin (~ 12 million). So why Gabon?

Read more: Gozem’s ride-hailing service goes live in Gabon, with Cameroon and DR Congo in view

Paystack expands to South Africa

We haven’t heard much from Nigerian fintech startup Paystack since it was bought by fintech giant Stripe last October. The deal, worth more than $200 million, caused a buzz in the African tech ecosystem and offered some form of validation to work done by founders, startups and investors alike.

Yesterday, the payments company, which is actively present in Nigeria and Ghana, announced its official launch in South Africa. The South African launch was preceded by a six-month pilot, which means the project kickstarted a month after Stripe acquired it.

Why it matters: For Stripe, all roads lead to its highly anticipated IPO and it has been aggressively expanding to other markets. Before acquiring Paystack, the company added 17 countries to its platform in 18 months, but none from Africa. Paystack was its meal ticket to the African online commerce market, and CEO Patrick Collison was clear about that when talking about the acquisition in October.

Expansion strategy: Paystack is often compared to Flutterwave, the other major Nigerian fintech player. Although their services are similar, their expansion strategy is different. While Flutterwave is in 20 African countries, Paystack which is in only 3 African countries is taking it slow and steady.

“Our goal isn’t to have a presence in lots of countries, with little regard for service quality. We care deeply that we deliver a stellar end-to-end payment experience in the countries we operate in. And this takes some time, careful planning and lots of behind-the-scenes, foundational work.” Abdulrahman Jogbojogbo, product marketer at Paystack said to Techcrunch.

In other news: MTN Rwanda made history in Rwanda by being the first mobile network operator to list its shares on the Rwanda Stock Exchange (RSE) earlier this week.

TC Insights: Funding tracker

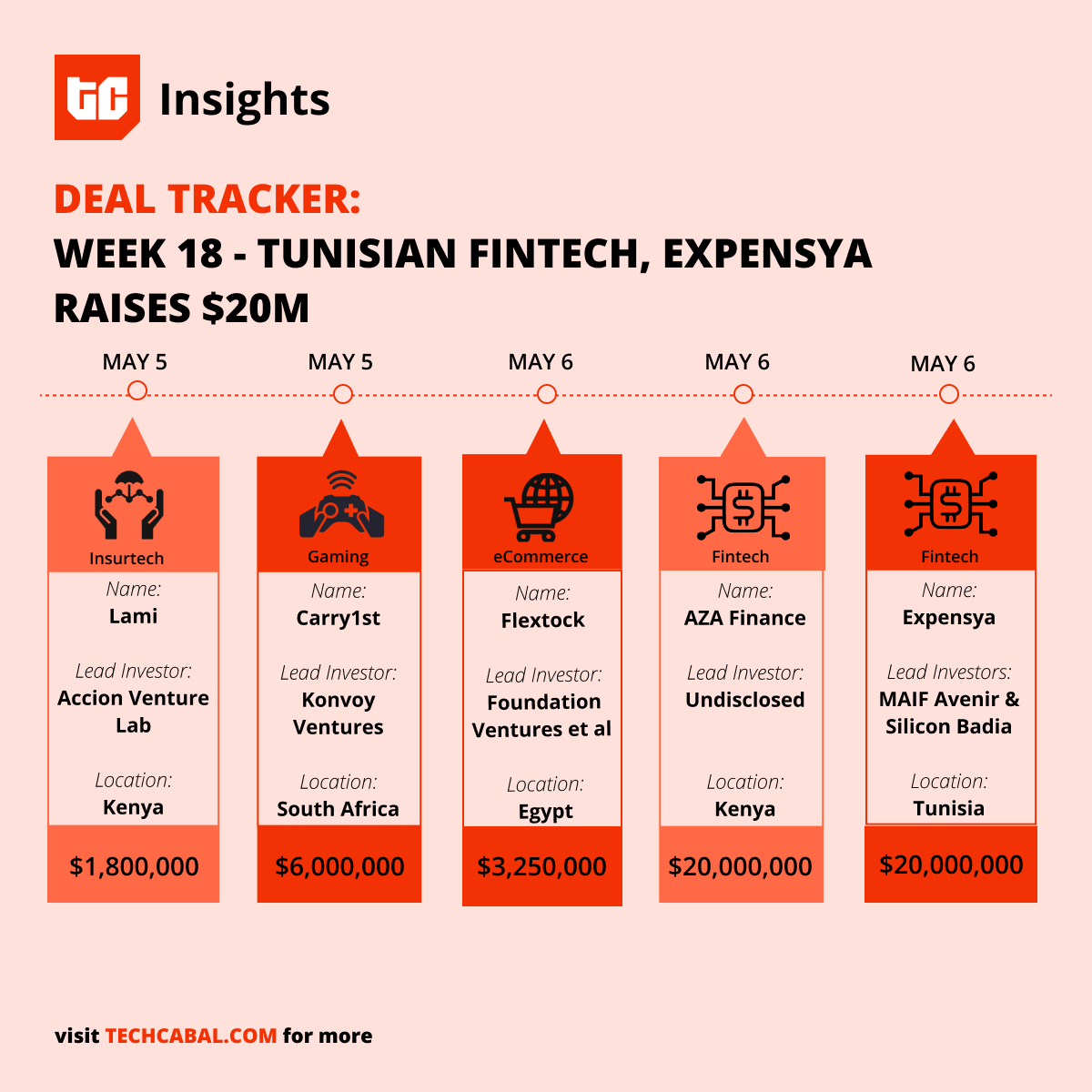

It’s been a big week for startups in Africa. Total funding received went from $2.2 million last week to over $52million this week. That’s a huge leap.

Here are the deals this week:

- Kenyan insurtech, Lami raised $1.8m in seed led by Accion Venture Lab.

- Carry1st, a Cape-Town based gaming platform, closed a $6m Series A round led by Konvoy Ventures.

- Egyptian-based logistics startup, Flextock raised $3.25m from Foundation Ventures, MSA Capital, CRE Venture Capital, Alter Global, Jameel Investment Management Company (JIMCO), B&Y Venture Partners, Access Bridge Ventures, and Y Combinator.

- Rwandan e-commerce platform, Kasha secured undisclosed funding from Mastercard.

- Kenya’s AZA Finance raised $20m in additional funding from undisclosed sources, and also expanded into South Africa with the acquisition of Exchange4Free.

- Ensibuuko, a fintech startup based in Uganda, raised $1m from FCA Investments.

- Tunisian-based fintech, Expensya raised $20m in a round led by MAIF Avenir and Silicon Badia.

That’s it so far this week. For more updates, stay tuned by following us on Twitter or LinkedIn.

job opportunities

- Sprimed Solutions – Freelance Intern

- Venture for Africa – Investment Associate

- Venture for Africa – Product Manager

- Reliance Health – Product Designer and Frontend Engineer

Check out other opportunities on our Job Opportunities page