Read this email in French.

Editor’s Note

- Week 11, 2023

- Read time: 5 minutes

Another week, another lineup of interesting, insightful, and sometimes controversial tech stories from around the continent. Welcome to another edition of TC Weekender.

Enjoy!

Pamela Tetteh Editor, TechCabal.

Editor’s Picks

|

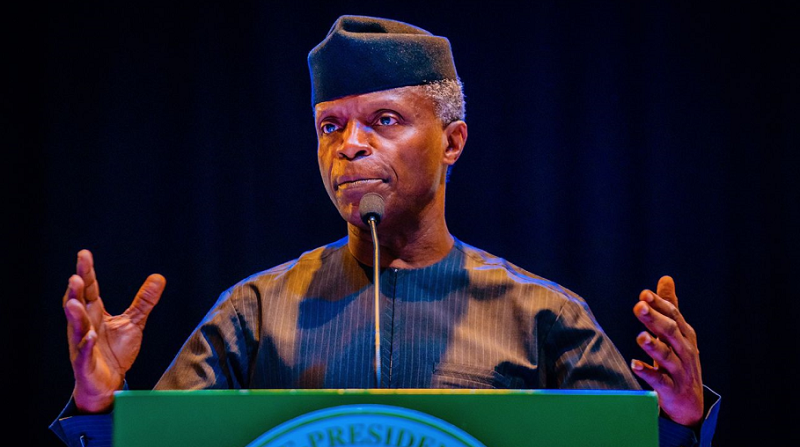

Nigeria’s $672 million fundNigeria has launched a $672 million fund for 18 to 35–year olds in its tech and creative sectors. The fund, named The Investment in Digital and Creative Enterprises (i-DICE), will see investments across 200 tech and creative startups, and 450 tech-powered SMEs. Learn more. |

|

Rain finds its voiceData-only telecom Rain has expanded into the mobile voice market months after merger talks with mobile network operator Telkom collapsed. This makes Rain the newest in the South African telecoms market, which is currently being dominated by the duopoly of MTN and Vodacom. Learn more. |

|

Flutterwave acquires licences in RwandaA month after acquiring two licences in Egypt, Flutterwave has obtained its Electronic Money Issuer and Remittance Licences from the National Bank of Rwanda. Learn more. |

|

Nigeria welcomes back old notesNigeria’s cash crisis is over. Ten days after Nigeria’s Supreme Court ruled that the ₦200, ₦500 and ₦1,000 notes will remain legal tender until December 31, 2023, the country’s apex bank acknowledged the court’s ruling. Learn more. |

|

SA’s largest VC fund shuts downAfrica’s most valuable company by market capitalisation, Naspers, has shut down its $100 million venture capital fund, Naspers Foundry, in an effort to scale down its operations. Learn more. |

|

Y Combinator lays off staffY Combinator is cutting 17 staff members, almost 20% of its headcount. It will also write fewer cheques for late-stage companies and focus on early-stage startups Learn more. |

Event: TechCabal At 10

Here’s a list of all the Twitter Spaces we’ll be holding to celebrate our 10th-year anniversary.

- March 14—Beyond Funding: Meet the team leading TechCabal’s newsroom. Why is TechCabal telling the kinds of stories we are telling now, and how this thinking has influenced our expansion drive? How is TechCabal’s editorial leadership driving this?

- March 16—Building newsletters readers want. How has TechCabal grown to build seven newsletter products, and what drove this growth? How does TechCabal measure success when it comes to its newsletter products, and what are its plans?

- March 21—Meet the team telling African tech stories that matter. TechCabal captures the players, human impact and business of tech in Africa. We provide the content, reporting, data, and context to help the world understand how tech is changing Africa. Who are the journalists doing all of this important work?

- March 23—What is the future of tech in Africa? In the last 10 years, the African tech ecosystem has evolved quickly. We know this firsthand at TechCabal. What does the future look like? Join us for an insightful conversation with Ola Brown, Stephen Deng, Hope Ditlhakanyane, and Ngozi Dozie where we answer these questions.

- March 30—The role of the media in covering African tech. How can the media help Africa’s developing tech ecosystem? What responsibility does the media owe the ecosystem, and what can the media expect in return? Should the media only cover good stories?

|

MTN Nigeria raises $271 millionMTN is trying to raise money to fund its commercial paper issuance. Last week, MTN Nigeria announced that it had raised ₦125 billion ($271 million). Now it is divesting its assets too as part of its fundraising efforts. Learn more. |

|

HSBC buys SVB for $1The UK arm of Silicon Valley Bank (SVB) has found a new home. HSBC UK Bank, a subsidiary of HSBC Holdings, has acquired Silicon Valley Bank UK for £1 ($1.21) after the bank was closed down by regulators due to panic withdrawals. Learn more. |

|

Chipper Cash is considering a saleAfrican unicorn Chipper Cash is reportedly considering selling the company or seeking new investors. This news comes after TechCabal reported that Flutterwave, another fintech unicorn, may have to raise money below its $3 billion valuation this year. Learn more. |

|

Are African investors sticking with SVB?Despite the crash, some African investors remain confident in Silicon Valley Bank (SVB) or its new entity, Silicon Valley Bridge Bank. Some have even asked their portfolio companies to return any deposits they wired out of SVB. Read more. |

Who brought the money this week?

This week, Nuru, an energy company based in the Democratic Republic of Congo (DRC), secured $1.5 million in a Series B funding round. The company is on track to build 13.7MWp of isolated solar-hybrid grids by mid-2024 and aims to provide world-class connectivity to five million clients in the DRC.

The Renewable Energy Performance Platform (REPP), Proparco, and E3 Capital each invested $500,000 in Nuru, bridging the financing gap for its $25 million Series B equity fundraising.

TC Game: Guess the word

You need a crowd to throw me.What am I?

What else to read this weekend?

- Naspers Foundry is folding: Where are its alumni?

- Google brings AI to its workspace

- How South Africa wants to protect bank customers

- How startup cereal brand got Ronaldo, Dwayne Johnson, Serena Williams, and Micheal Jordan to endorse their products on a budget

- Collate wants to put election transparency in the hands of Nigerians

- Silvergate collapse: African fintechs search for new partners

- Why are states not domesticating the Nigerian Startup Act?

Written by: Ngozi Chukwu

Edited by: Pamela Tetteh