Africa added 50 million new mobile money accounts in 2019 as the number of registered accounts globally surpassed the 1 billion mark for the first time.

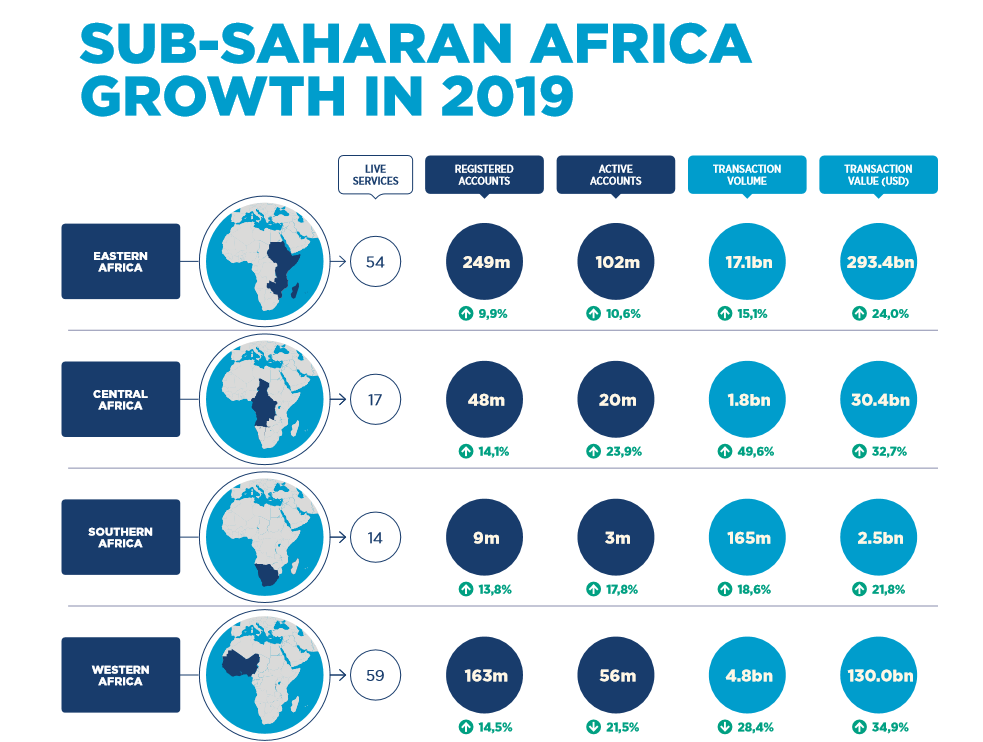

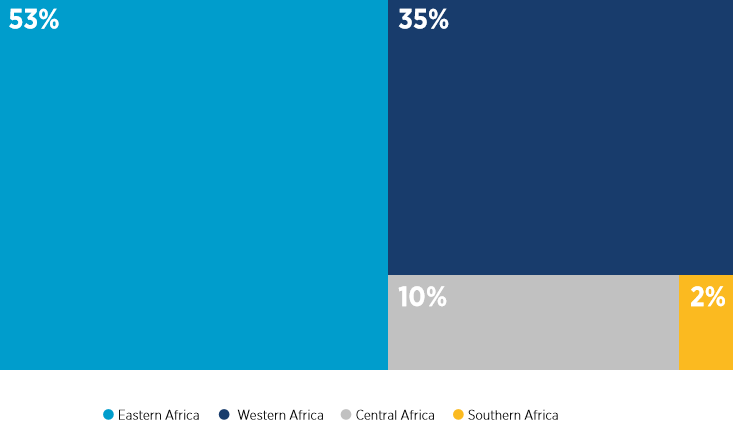

East Africa, home to Safaricom’s MPesa, remains number 1 in the world in terms of transaction volume and value, according to the GSMA State of the Industry Report on Mobile Money 2019. The region’s 102 million active accounts is the highest in any sub-region; its 17.1 billion transactions generated an unmatched $293.4 billion in value, a 24% increase from 2018.

The Central African region stood out for registering a 49.6% increase in transaction volume, the highest year-on-year growth on the continent.

But while East Africa had more transaction volume and total value, mobile money transactions in West Africa had an average value of $27, compared to less than $18 per transaction in other regions in Africa.

Indeed, West Africa has become a force in Africa’s mobile money revolution. The sub-region witnessed the highest increase in number of registered accounts (14.5%) and transaction value (34.9%). Also, there are now more live mobile money services offered in West Africa (59) than in any other region in the world.

Since the launch of MPesa in 2007, more than 144 mobile money services have been operational in Africa. In Nigeria, a foremost example is Paga, the fintech that serves 15 million users through a consumer channel and agent network of over 24,000 agents.

MTN and Airtel Tigo have helped drive a six-fold growth in Ghana between 2012 and 2017, making it an exemplary fast-growing market. In Côte d’Ivoire, MOOV, Orange and other players have leveraged a 2015 regulation which authorised non-banks to issue electronic money, spurring a 20% increase in financial account ownership across the country.

Overall in Africa and the rest of the world, agents remain the backbone of mobile money transactions.

In 2019, agents digitised $176 billion worth of cash-in transactions, surpassing the total value of formal international remittances flows to Sub-Saharan Africa, Latin America and the Caribbean combined in the same year. Agents collect cash and transform it electronically to facilitate the money transfer and lending across the world.

The high importance of agents is underscored by their availability relative to ATMs and bank branches. For 100,000 adults in the world, there are 228 mobile money agents ready to provide digitised financial services. But there are only 11 banks and 33 ATMs for the same number of people.

Mobile money delivery differs by geography, available infrastructure and market behaviour. While new fintechs and banks play a significant role in Africa, telcos are the operators looking most capable of sustaining the mobile money boom, according to Wiza Jalakasi, a technology and financial services analyst.

“The mobile money providers were able to reach the consumers before the banks, they set the status quo for what the default will be,” Jalakasi says to TechCabal.

As more subscribers take up mobile money platforms, network effects improve quality of service, deeping customer dependence and the value derived. Building on the communication services they provide, telcos bundle financial services for their users in ways that banks and fintechs are not able to.

It doesn’t seem like mobile money in Africa is a mere means to owning a ‘proper’ bank account. Jalakasi points to the difficult onboarding process for getting a bank account relative to signing up for a mobile money service.

Banks are going digital but they often require that users sign up on an app, thereby cutting off those who do not have access to smartphones and reliable internet connection. A Nigerian example is Standard Chartered bank which launched its digital bank app to offer retail lending services. As admirable as it is, the scope of the service is unlikely to include those already excluded from existing banking infrastructure.

However, a key concern is that mobile money usage remains expensive in East Africa relative to traditional banking.

In response to a request by the Kenyan government, Safaricom and other operators waived charges for transactions less than $10 for 90 days to discourage the use of cash in this period of the coronavirus pandemic. Kenyans have called for this regime to be maintained to further entrench digital finance in the country. An increase in new and active accounts will likely be recorded in the coming months.

The GSMA report remarks on Nigeria’s awakening to its market potential. 60% of Nigeria’s 114 million adults are unbanked, making it a fertile ground for deploying the kind of agent banking services that have boosted financial inclusion in East Africa over the last decade.

In 2019, serious financial support helped scale mobile money in the country, thanks to activities by MTN, OPay, PalmPay, Flutterwave and others. The investment by Visa into Interswitch – making it Africa’s first fintech unicorn – exemplified the momentum that had been building over two decades.

[Read: MTN granted operating license for financial services in Nigeria]

The increase in digital finance activity in Nigeria has benefited not just from investor interest but also a rise in smartphone penetration from 12 to 40% in just five years, the report says.