Venture funding in the first quarter of the year was not terrible for African startups. Considering the ravaging impact of the coronavirus on the world, it would have been sensible to expect a bad outing for the continent’s tech economy.

But performance between January and March 2020 mirrors what we had in the first quarter of 2019.

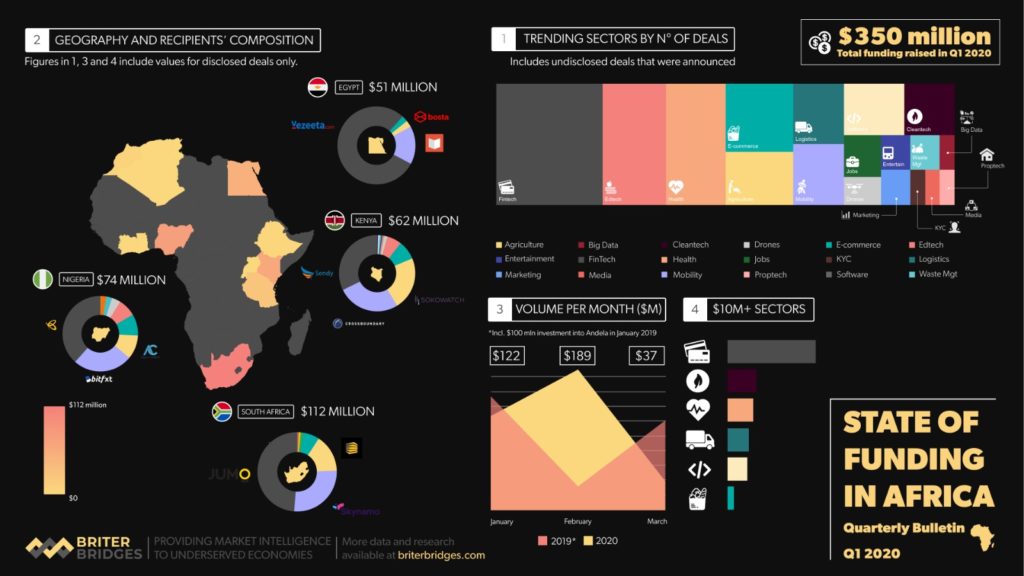

In total, approximately $350 million was raised in African tech according to data from Briter Bridges, a tech ecosystem data consultancy. South Africa, Nigeria, Kenya and Egypt led the way. These four received the largest share of funding in the whole of 2019.

Notable receipts from the first quarter include the $55 million debt and equity financing raised by Jumo, a financial services company based in Cape Town.

Flutterwave’s $35 million Series B made up more than half of what startups raised in Nigeria. Another Series B was Sendy’s $20 million, which showed the rising tide of e-commerce in Kenya.

Away from the sub-Saharan region, there was a Series D in Egypt where doctor-booking platform Vezeeta raised $40 million. That could set the stage for more interest in healthcare funding on the continent.

Briter’s data tracked disclosed and announced deals. “A significant proportion of the capital injections into companies remain unseen as they are never made public,” says Dario Giuliani, the firm’s founder.

According to WeeTracker, 86 deals were announced in Q1 2020, comprising funding from accelerators, incubators, grants, and prize monies. They estimate that total funding from these disclosed deals totaled $245.13 million.

African startups raised $576.98 million in the last three months of 2019, per Weetracker’s research. It would seem that the coronavirus has had a dipping effect on early 2020.

However, it is important to note that Q4 2019 included monumental deals by Interswitch ($200m) and OPay ($120m).

Also, some funding announcements can come weeks or months after deals are closed. There is a need for circumspection around direct comparisons between successive quarters.

Giuliani estimates that funding in the first quarter of 2019 totaled about $300 million (Weetracker pegs it at $186.09). A third of that was due to Andela’s $100 million Series D round. In that sense, the last three months have not been bad in comparison.

There are bound to be differences in estimates for what has been raised so far. Depending on who you asked, total funding in 2019 ranged from $469 million to $2.02 billion.

However, there is a convergence in opinion among founders and investors that the current pandemic will have a cooling effect on the ease with which startups raise funds in the months to come.

Briter’s Q1 2020 data shows fairly normal activity occurred in January and February. But the 80% drop in March – the month in which Africa really began to feel the coronavirus burn – is ominous.

Partech Africa’s 2019 report says VC funding grew by 74% between 2018 and 2019. The near-certainty of a recession in the major economies that fund African startups will make the recurrence of such growth improbable.