IN PARTNERSHIP WITH

Good morning ☀️ ️

Here’s a snapshot of of the new iPhone 13 series 👇🏾

Sleek, right? Well, here’s a picture of me going through the price tags 👇🏾

Apple’s latest event unveiled four new iPhones: the iPhone 13 mini at $699, the iPhone 13 at $799, the iPhone 13 Pro at $999, and $1,099 for the iPhone 13 Pro Max! There are also new iPads and watches too.

There’s nothing exciting from this year’s unveiling though; no new tech or groundbreaking features – nothing we haven’t seen before, but the new iPhones are coming with slightly bigger batteries for longer use. So soon and very soon, iOS users will be able to move around without power banks attached to their hips. 😅

Anyway, let’s move into today’s edition.

In today’s edition:

- Bamboo is back in business

- Africa’s first digital credit collection company

- Jumo partners with MTN to improve loan access in Cote d’Ivoire

- How Flutterwave is helping other businesses grow

- Events: The #FutureofCommerce

BAMBOO OBTAINS COURT ORDER TO UNFREEZE ACCOUNTS

Bamboo, a Nigerian stock trading app, has obtained a court order to unfreeze its accounts so it can carry out its operations.

Remind me, what’s up? Last month, the Central Bank of Nigeria moved to freeze the bank accounts of four Nigerian online trading platforms Risevest, Trove, Chaka, and Bamboo for 180 days.

There was a bit of cloak-and-dagger around CBN’s move. For one thing, the move was made through an ex-parte motion, one that offered no notice to the affected parties, so we were all caught by surprise.

Another is the reason for the move: a CBN directive from 2015 which limits certain platforms from operating without certain licenses.

Who was affected?

In a sense, everyone with an account on the platforms. While the affected platforms reached out to their customers to assure them that all investments were safe, they still couldn’t run their businesses as smoothly as they would have.

The affected bank accounts were Nigerian-based, so all operational costs, like salaries or rent, are paid using these bank accounts. It’s been a month since the freeze, so it stands to reason that a lot has been put on hold for these businesses.

At least, this is the case with Bamboo who made an earlier request to the court to have their accounts temporarily unfrozen so they could pay rent and salaries.

Does this mean all four platforms are free?

For now, only Bamboo’s accounts have been unfrozen, but it’s expected that Risevest, Trove, and Chaka will challenge CBN’s initial action.

AFRICA’S FIRST DIGITAL DEBT COLLECTION AGENCY

If you’ve ever seen those get a quick loan in five minutes ads, then you’ve probably also thought of the wry tactics lenders use in getting defaulters to pay back.

As the digital lending space grows larger, so does the possibility of defaulting on those loans. In Nigeria, the average percentage of defaulters across top digital lending companies is 10%. In Kenya, the rate for defaulting, at 2018, was 12% while Tanzania’s was 31%.

This translates to thousands of customers who are unable to pay back their loans due to one reason or the other. It also translates to hundreds of thousands that hang in the balance.

To get defaulters to pay back, digital lenders often engage in scare tactics or even shame peddling, sending messages which pronounce the defaulters as fraudsters to their families and contacts. In fact, the Nigerian Information and Development Agency (NITDA) recently fined Soko Loan for doing something similar.

Not everyone wants to use unethical means though.

BFree, Africa’s first digital credit collection company, wants to help digital lenders get their money back while retaining the trust and confidence of their customers.

An ethical approach

Far far away from the approach of other debt collection solutions, BFree focuses on ethics and technology in debt recovery.

BFree helps lenders collect loans from their borrowers for a fee.

The startup’s ethical approach to loan recovery is guided by a data-backed belief that the majority of customers take a loan with the intention to repay. Of course, with the exception of isolated cases of fraudsters and fraud victims.

Believe it or not, their approach involves a bit of understanding and it’s worked so far.

How does it work?

This debt collection process basically starts as a self-service platform where customers can log in and see their own repayment plans.

Customers also get SMS messages and perform loan repayment activities themselves. This way BFree reduces the number of man-hours spent on making calls and customers aren’t forced to deal with unexpected phone calls during working hours.

In the case where a customer defaults, BFree reaches out to the borrower to find out why and to also get a promised date of payment.

It doesn’t always work though and even though the startup has 460,000 active customers from over 20 lenders in Nigeria and Kenya, they’re also accepting that sometimes, defaulting on loans is inevitable.

Daniel Adeyemi has more in How BFree is improving trust in the lending space.

Increase your online sales with a Paystack Storefront – a free, beautiful seller page that helps you bring creative ideas to life.

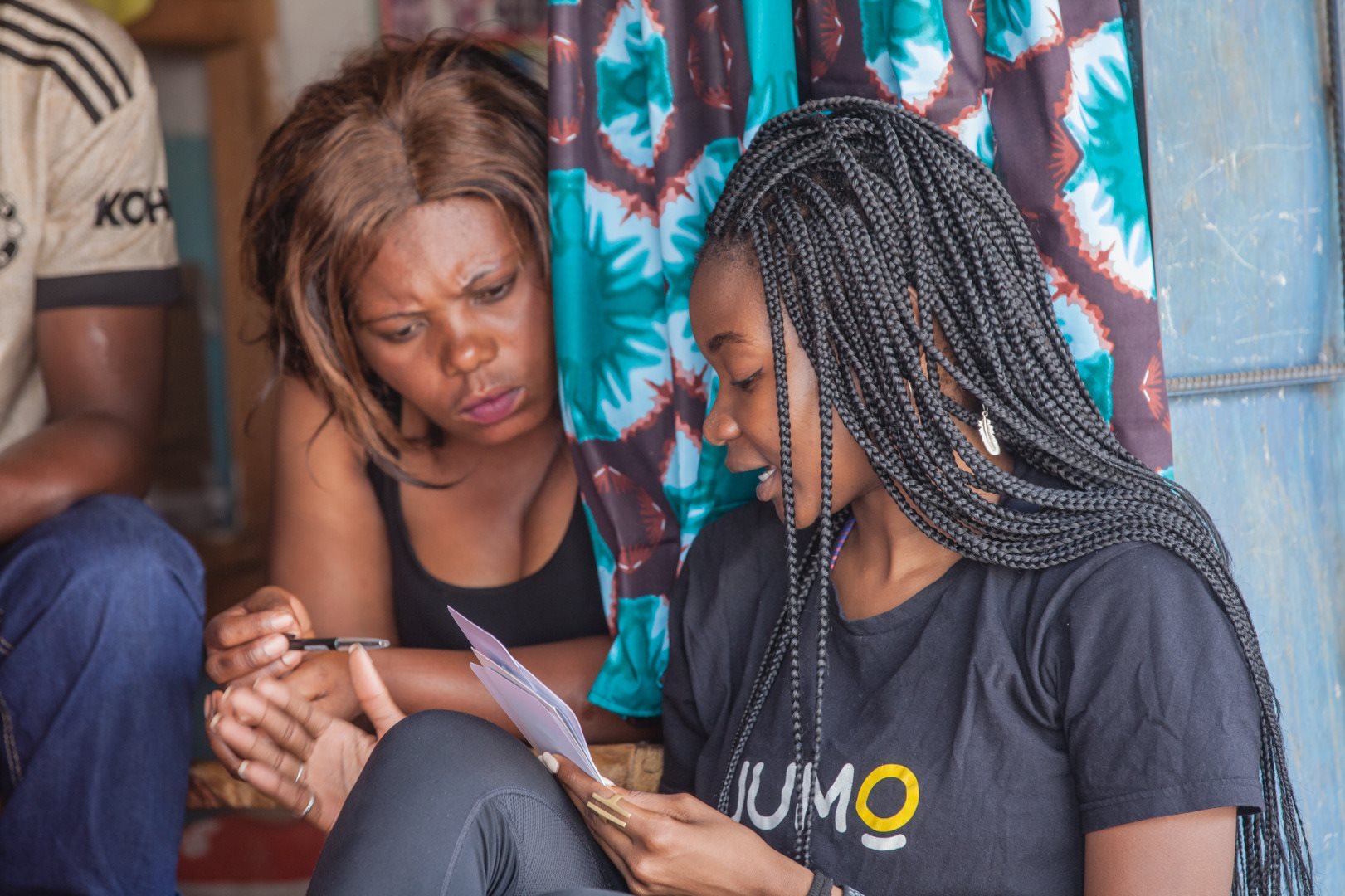

JUMO PARTNERS WITH MTN TO INCREASE LOAN ACCESS IN COTE D’IVOIRE

Ivory Coast is Jumo’s most recent market and they’re pushing in with a new product.

Vitkash is a short-term small-scale loan product micro-entrepreneurs with reduced access to finance can use to develop positive credit records through responsible loan management.

In West Africa, entrepreneurs in the informal sector contribute an average of 60% to the GDP of West African countries yet less than 15% of them have access to banks as a source of financing.

Vitkash wants to tackle this issue head-on.

Jumo is operating Vitkash in partnership with Mansa Bank and MTN Cote d’Ivoire’s mobile money platform, and mobile money involvement will definitely help the product grow.

How?

Mobile money is a huge driver of financial inclusion in Cote d’Ivoire, accounting for at least 20% of the increase in financial account ownership across the country from 2014 – 2017. By 2018, the mobile money market in the country had grown to handle $30m worth of transactions per day.

Zoom out: 80% of all the firms in Cote d’Ivoire are SMEs but very few of the SMEs in the business can actually get loans because they have little to no credit history. Jumo seems to be on the right path with Vitkash and it’ll be interesting to see how much it’ll improve financial inclusion in the country.

KB4-CON EMEA is a free, highly engaging, cybersecurity-focused virtual event designed for CISOs, security awareness and cybersecurity professionals in Europe, the Middle East and Africa.

The event will be on Thursday, September 23rd and features keynotes from two of the most well-known figures in cybersecurity. Mikko Hyppönen will cover how our global networks are being threatened by surveillance and crime, and how we can fix our technical, and human, problems. Kevin Mitnick will reveal social engineering tradecraft and insights and wow you with a live hacking demonstration. You can register here.

HOW FLUTTERWAVE IS HELPING BUSINESSES GROW

Flutterwave has done a lot of exciting things this year.

First, the fintech became Nigeria’s third unicorn, raising $170m with a valuation of $1bn. The company also developed its partnership with Worldpay to ease online card payments for Nigerians and South Africans.

Now, it’s announced a new product, Flutterwave Grow, to help people register their businesses in the US, UK, and Nigeria.

Why this is important?

Registering a business is a hassle, especially in Nigeria. While there are digital components to it, getting a business incorporated in Nigeria still involves a lot of running around, some legalese that can confuse the hell out of us all, and a lot of paperwork.

Flutterwave Grow wants to simplify that process.

It not only aims to ease the incorporation procedures in Nigeria, but it also wants to help businesses get incorporated in the US and UK.

If the company is able to pull it off, it means people can build global businesses without the need to know someone somewhere who can help you out.

How does it work?

Flutterwave will do almost everything for you, incluing filing the paperworks and handling the application processes.

All you’ll have to do is register, submit your documents, and pay the required fees. That’s all.

There’s still a lot to learn about Flutterwave Grow, especially the requirements for setting up corporate accounts in the US and UK but the company is accepting individuals and businesses into a wait-list where updates will be shared.

Next on the Grit & Growth podcast: meet Elo Umeh, CEO of Terragon Group, a Nigerian marketing and insights firm, and experts from TLcom Capital, and learn how to maximize the value of your firm’s next fundraising round. Listen here.

#FUTUREOFCOMMERCE2021: MEET A SPONSOR

G is for GIG Logistics

What does GIG Logistics do?

GIGL is Africa’s leading logistics company, powered by technology. The company’s footprints are set in the areas of personalised services, e-commerce logistics, freight forwarding, haulage, warehousing, distribution, mailroom services, and more.

GIGL is rapidly expanding across Nigeria, Ghana, the UK, and the USA with a robust global network that offers domestic & international, intra & inter-state delivery services.

Will someone from GIGL be speaking at the event?

Yes! Ocholi Etu, Director of Operations at GIG Logistics will be speaking on a panel tagged “The Future of Logistics”.

Ocholi is a seasoned business leader as well as an astute management and supply chain professional with over 15 years of industry experience.

Prior to joining GIGL, he was the MD of Red Star Logistics (FedEx, Nigeria), Regional manager in MDS Logistics (UACN), and MD at Abe Nello Associates Ltd, a management consulting firm he founded and managed.

Read more about Ocholi and all the other speakers that will be at #FOC2021 here.

If you still haven’t registered, there’s not that much time left. Sign up now.

The Future of Commerce is brought to you in partnership with DAI Magister and Paystack and is sponsored by Doroki, Chipper Cash, Klasha, VerifyMe, and GIG Logistics.

OPPORTUNITIES: APPLY TO BECOME A HARAMBEAN

The Harambean Alliance is calling for applications from African innovators for its 2021 class.

Harambeans are African innovators who have pledged to work together as one to unlock the potential of Africa. Over the last decade, the network has spawned a series of tech-enabled ventures such as Andela, Flutterwave, and Yoco, collectively generating over 3000 jobs, raised over $700m from Google Ventures, CRE Ventures, and Accel.

During the course of the class, selected innovators will get access to a network of investors, venture capital funding through the Harambean Prosperity Fund, and fellowships.

Find out more and apply here.

What else we’re reading

- Here are the ten African countries with the cheapest data plans.

- Google has been fined $177 million for stifling competition in South Korea.

- Ethiopia is spending $40bn to become Africa’s clean energy hub.

- Less than two months after its groundbreaking IPO, one of Zomato’s co-founder just quit the company and it may be for the right reasons.