IN PARTNERSHIP WITH

Good morning

More emojis are coming to WhatsApp reactions.

A few weeks ago, WhatsApp released a feature that allowed users to react to messages with 1 of 5 emojis.

Now, it’s testing out an update that will allow you react to messages with any emoji you have in a keyboard. We’re going from 5 to 100 in a matter of weeks!

The update is still in beta and is only available to a few users for now.

In today’s edition

- Google Banalytics

- Moove moves fast

- TC Insights: Fintech’s new frontiers

- Puzzles: Guess the app

- Job opportunities

GOOGLE BAN-ALYTICS

Last week, we told you about the US’ concerns about China using TikTok to harvest its citizens’ data. This week, the US is getting served a taste of its own medicine.

What’s happening?

Since December 2021, 4 European countries have banned Google Analytics.

It started with Austria declaring the service illegal in December 2021. France and Holland quickly followed months later in February 2022. More recently, Italy joined the fray.

But why?

To understand why these countries are banning Google Analytics, it’s important to understand what kind of data it collects. Every time you visit a website, any website, Google Analytics notes the time and date of your visit, the browser you use, your IP address, screen resolution, operating system, and language selection, among other items.

Most websites use this data to track what kind of content readers like and curate content around these preferences.

Now all this data Google Analytics collects is stored in the cloud, but not in storage centres in different countries. Instead, Google stores the data in data centres, most of which are scattered across the US.

This is where the problem comes in. Websites across the world—in different countries—who use Google Analytics basically have the data of their users/customers in the US, and that data is reportedly unprotected.

While the US itself has surveillance laws that prevent the US government from accessing the data of Americans, those laws don’t protect people living outside the US.

And many European countries worry that this means that US officials can access their citizens’ data and use it for nefarious purposes similar to how Facebook allowed Cambridge-Analytica to harvest user data for Trump’s political campaign in 2016.

Big picture: Google Analytics isn’t the only one facing some pushback in Europe. In fact, since 2020 over 5,000 US-based tech companies have been struggling after the European Court struck down Privacy Shield, an agreement that allows US-based companies to transfer user data from Europe to data centres in the US. Now, many are faced with banishment or building expensive data centres in Europe.

Don’t just send money, send money fast. Send and receive money directly to mobile wallets, bank accounts, Barter or through cash pickup with $end.

Visit send.flutterwave.com and do it now!

This is partner content.

MOOVE MOVES FAST

Nigerian mobility financing startup, Moove, is moving fast this year.

In February, it raised $10 million in debt financing, and less than a month later, it announced a $105 million mega funding raise.

Now, it has received a $20 million investment in debt funding from the British International Investment (BII), the UK government’s Development Finance Institution (DFI).

ICYMI: We know terms like “debt funding” or “equity funding” can be a bit confusing so we’ve created this explainer to help you understand it better.

Back to Moove

What all this means is that this year alone, Moove has raised $135 million—and we’re only halfway through 2022. The total funding, adding its initial investment before this year—seed and Series A ($23 million)—is now at $194.5 million.

According to Moove’s co-founder Ladi Delano, the funding has put the startup in a stronger position to help its customers, who are typically ride-hailing drivers, purchase brand-new vehicles using a percentage of their weekly revenue.

DFI’s change

Moove’s investor, BII, has also changed a few things. First, was the name change from CDC Group to BII.

It’s also appearing to change its strategy. Until recently, DFIs like BII were known to invest mostly through private equity and scarcely through venture capital. BII, for example, invested in Nigeria’s Capital Alliance Private Equity Fund I (CAPE I), managed by African Capital Alliance (ACA) and CardinalStone Capital Advisors Growth Fund, among others. It also invested in African-focused, early-stage-to-series-A venture capital TLcom. But now, DFIs have started dealing directly with startups: BII invested in Nigeria’s TradeDepot and TeamApt, and Kenya’s MKopa.

It’s either the DFIs are going through the fear-of-missing-out (FOMO) of the astronomical growth the startup ecosystem is currently experiencing or they have developed some risk appetite needed in startup investing.

Increase your online sales with a Paystack Storefront – a free, beautiful seller page that helps you bring creative ideas to life.

👉🏾 Learn more at paystack.com/storefront

This is partner content.

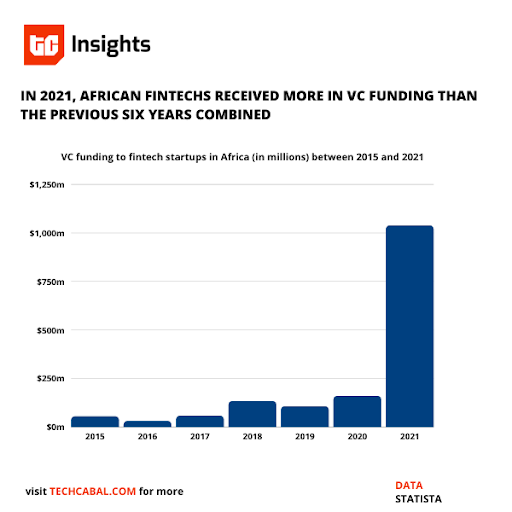

TC INSIGHTS: FINTECH’S NEW FRONTIERS

There are currently over 1 billion people living in Africa. This number is set to double to 2.4 billion by 2050. Similarly, consumer spending in the continent is projected to hit over $2.5 trillion by 2030.

Most sub-Saharan Africa (SSA) countries still pay for goods predominantly in cash. For instance, over 90% of retail transactions in Kenya are in cash. Similarly, many Africa countries have large underbanked populations. Africa’s largest economy, Nigeria, has only 36% of its entire population with a bank account, a situation that reduces saving ability in the country.

While fintechs have tackled the payments problem by making it accessible to large segments of the population with and without bank accounts, there is still more work to be done. But investors are confident in the ability of fintechs to achieve this goal, going by the investments that have accrued to startups within the sector in the last 5 years.

Kenya has few banks amid extremely high payment transaction costs in the country. The advent of M-Pesa has since reduced payment transaction costs, improved financial behaviours, and facilitated savings for Kenyans. A recent study has shown that the expansion of mobile money has lifted 194,000 Kenyans out of extreme poverty and has enabled 185,000 women to move out of subsistence farming and into business or sales occupations.

To enlarge the fintech pie, digital banks and fintech APIs have risen up to the challenge respectively. The former use technology to ensure customers are onboarded easily, reducing the need for a physical presence. They also provide credit facilities to customers at competitive rates, helping many people in SSA to make instalment rather than one-time purchases.

Fintech APIs on the other hand, allow merchants to take any form of payment transaction, instead of having to open up multiple accounts to accept different types of payments. This reduces fees for merchants and increases economic activity. They also allow users to access their bank account information when they log in to use finance apps on their phones.

According to Abdulhamid Hassan, co-founder of Mono, “Payments have been figured out. The next step is how we can enable other companies with data. That’s why you see companies like Okra and Mono coming up. Eventually, what we want to do is enable new types of companies that can use financial data to build new solutions.”

As more Africans become connected, more innovative solutions will spring up. To accelerate this, it is crucial to have preceding layers of technology at low cost and in an accessible way—a push that both digital banks and fintech APIs are driving.

Fincra provides easy-to-integrate APIs developed and designed to launch seamless and reliable global payment solutions.

With Fincra’s customisable APIs, developers can build quick financial applications.

Build the best payment solutions on Fincra.

This is partner content.

IN OTHER NEWS FROM TECHCABAL

Klasha has appointed a new CCO to drive its commercial infrastructure. Former vice president at Mastercard, Nile Younis, has left the international conglomerate to join the cross-border payment startup.

Every time an employee leaves a company, the company loses at least 20% of that employee’s annual salary in hiring a replacement. And the top reason most employees quit? It’s toxic workplace cultures. Here’s how these 3 HR professionals think you can build healthy workplace cultures.

Emeka Ajene: Lessons learned while building Africa’s super app, Gozem.

JOB OPPORTUNITIES

- Big Cabal Media – Head of Events, Associate Art Director, Associate Video Editor – Lagos, Nigeria

- Helicarrier – Growth Lead (Sendcash) – Africa (Remote)

- Lazerpay – Developer Relations Advocate, Senior Backend Engineer – Africa (Remote)

- Thepeer – Business Developer, Growth Lead – Africa (Remote)

- TikTok – Media Partnerships Specialist – Lagos, Nigeria

What else is happening in tech?

- Google’s Equiano cable lands in Namibia.

- EU to impose wide-ranging new rules on the crypto industry.

- Kenya acquires big data tools to ease and lower cost of doing business at Mombasa Port.

- Airtel Kenya appoints new CEO and Board Chair.