Filing tax returns can be a daunting task, but thanks to the LIRS eTax platform, the process has become much simpler and more convenient. LIRS, which stands for Lagos Internal Revenue Service, is the tax authority responsible for collecting taxes within Lagos State, Nigeria. The eTax LIRS platform allows taxpayers to file their tax returns online, from the comfort of their homes or offices.

In this article, we will provide a step-by-step guide on how to register to file tax returns with the LIRS eTax platform.

Step 1: Register for eTax as an individual on the LIRS platform

To use the LIRS eTax platform, you need to register first. To register, visit the LIRS eTax website at https://etax.lirs.net and click on the “Register” button on the homepage.

As a registering individual, you’ll be prompted to provide your personal information, including your BVN/NIN, Date of Birth, and Phone Number. Once you have provided the required information, click on the “Submit” button to complete the registration process.

Creating an Individual Taxpayer ID

To register on the LIRS eTax to pay, file, and manage your taxes, simply follow the following steps:

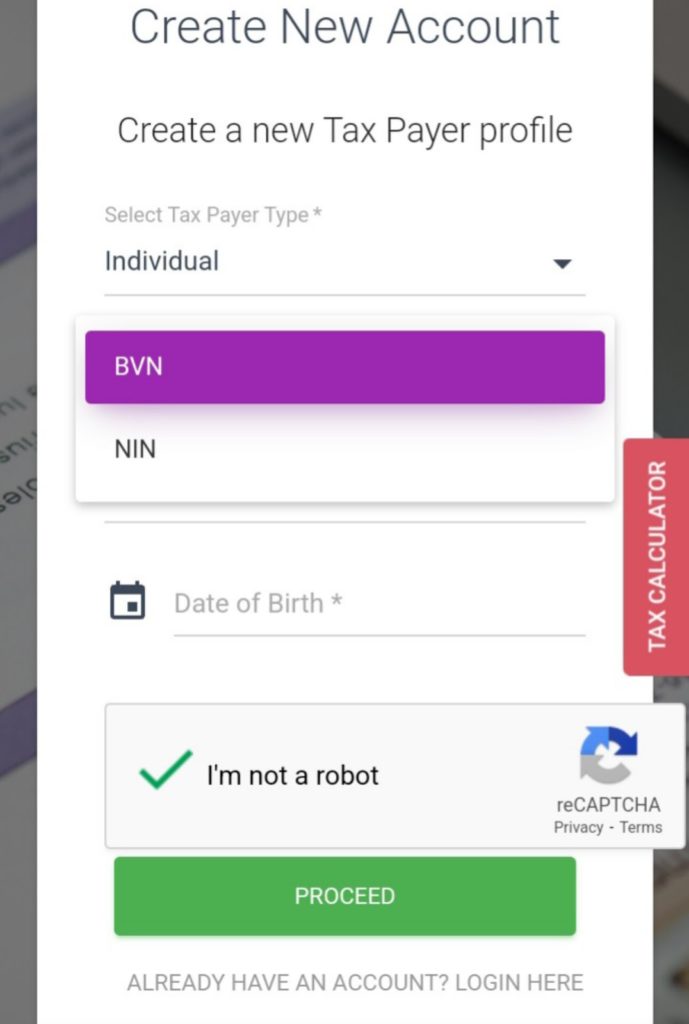

- Click on ‘Create New Tax ID’

- You should be redirected to the “CREATE NEW ACCOUNT FORM” PAGE

- Choose ‘Individual’ from the Taxpayer type drop-down options

- Choose the Identification System Type you want. You have the options of BVN or NIN.

- Input your Date of Birth.

- Verify the Captcha box that says ‘I am not a robot’.

- Click on the ‘Proceed’ button to complete the registration action.

Filling the LIRS eTax sign-up page before signing in to file tax

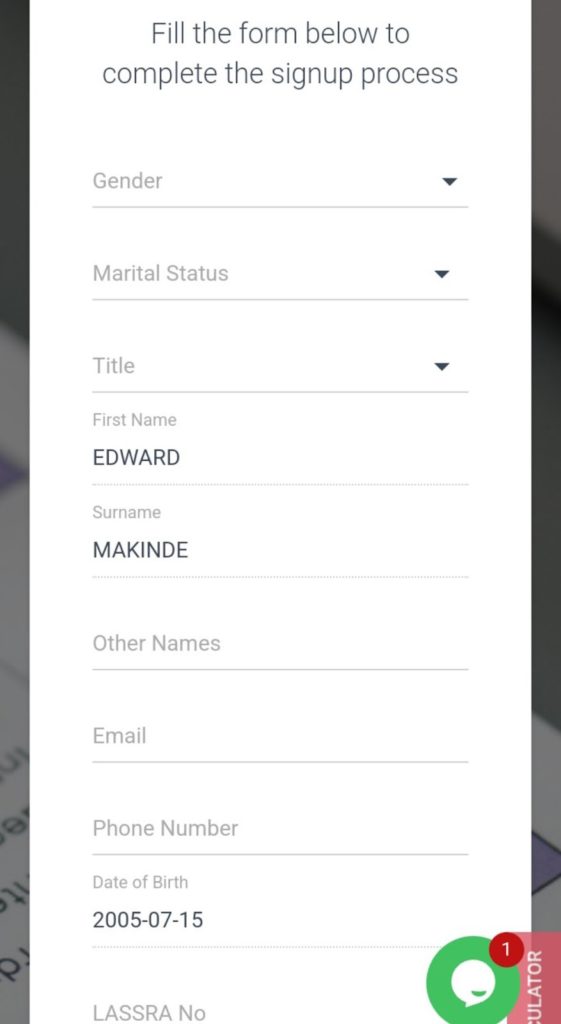

- Pick a suitable ‘Title’ from the drop-down.

- Fill in the fields for other names, email, occupation, phone number and address.

- Select your marital status from the drop-down list.

- Select your nationality.

- Select your gender from the drop-down list.

- Identify if you are a public servant or not.

- If you’re a public servant (Yes), select the agency you work for

- If you’re not (No), search for your business type and enter occupation

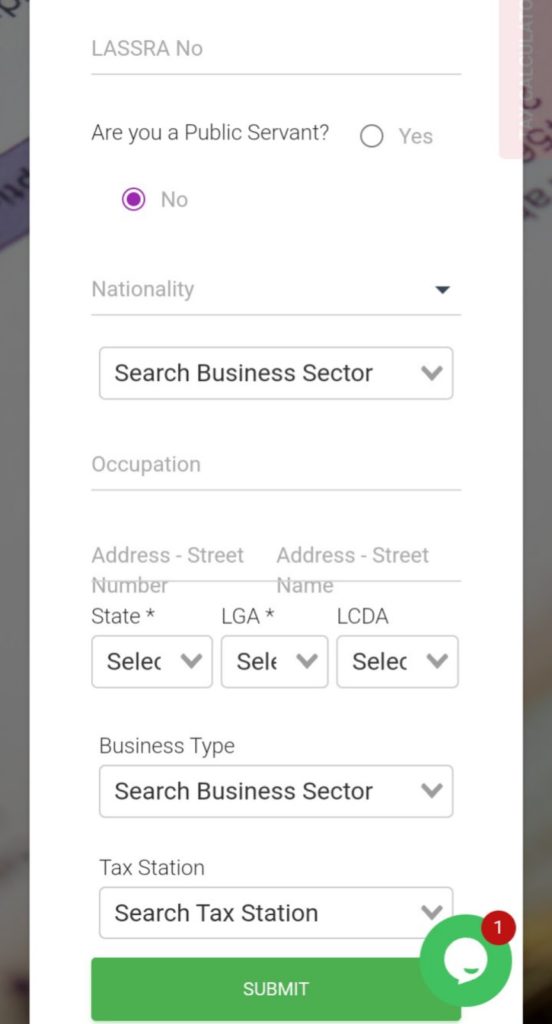

- Enter your address, including your street name, number, state, LCDA, and LGA.

- Choose your preferred ‘Tax Station’ from drop-down menu

- Then click ‘Submit’ to complete your registration. You’ll receive your taxpayer ID via email with the prompt to set up a password.

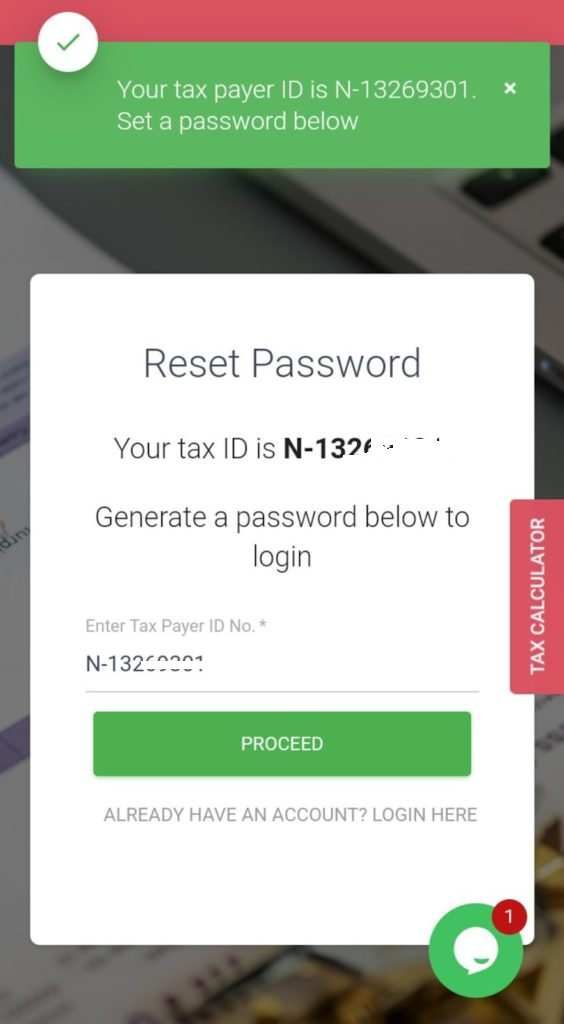

- You will be redirected to a page to set up your password

- Input your taxpayer ID

- Click the ‘proceed’ button to be directed to the ‘update password’ page

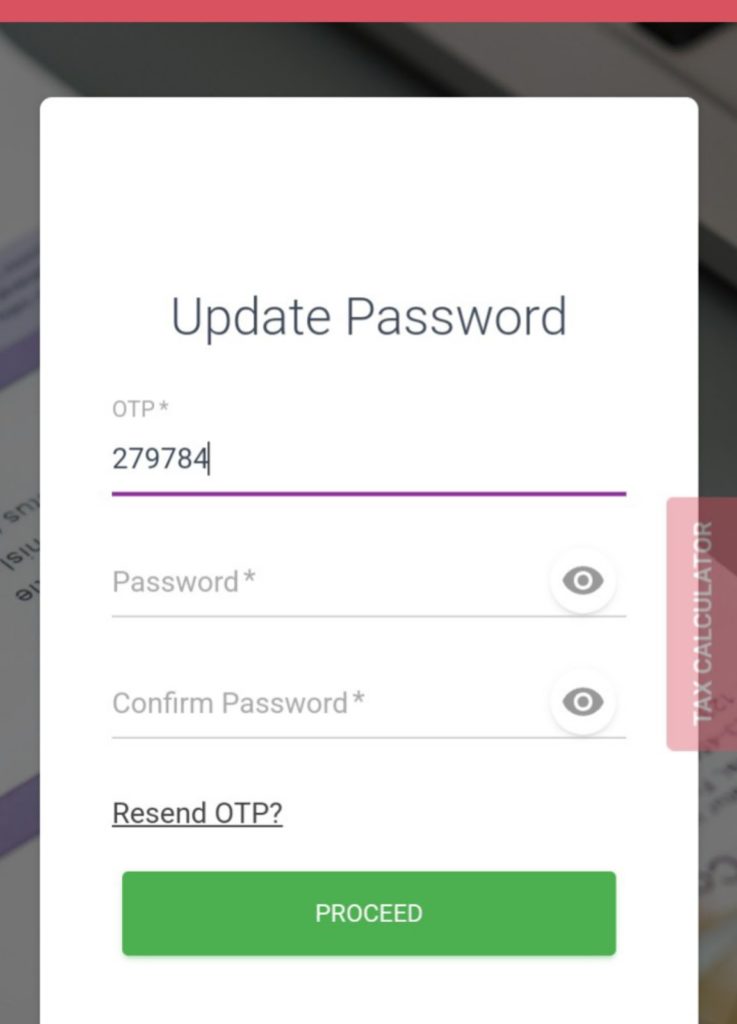

- Enter the 6-digit OTP that was sent to your email address

- Enter the password you’d like to use. Ensure to use at least one capital letter, one number, and a special character like “#” or “@”.

- Re-enter your password to confirm it. You can click the “Eye” icon to hide/show password as you type.

- Click the ‘proceed’ button to finish your registration and return to the login page.

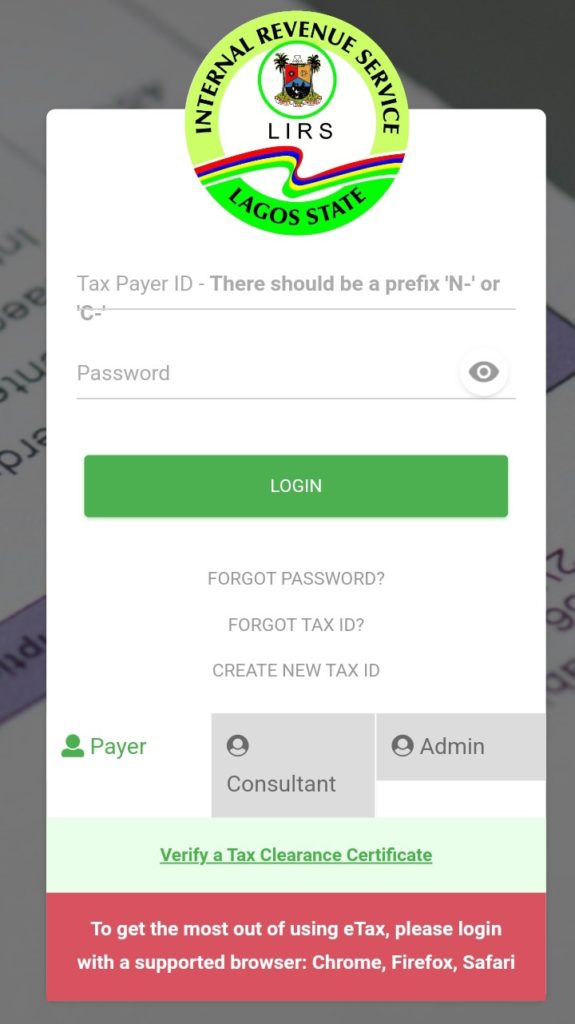

Step 2: Log in to your LIRS eTax account to file tax

After registering, you can log in to your eTax account by visiting the LIRS eTax website and clicking on the “Login” button on the homepage. Enter your TAX ID with the “N” in front and then enter your password to access your account dashboard.

You can then go ahead to update your LIRS eTax details and also upload a profile picture and more.

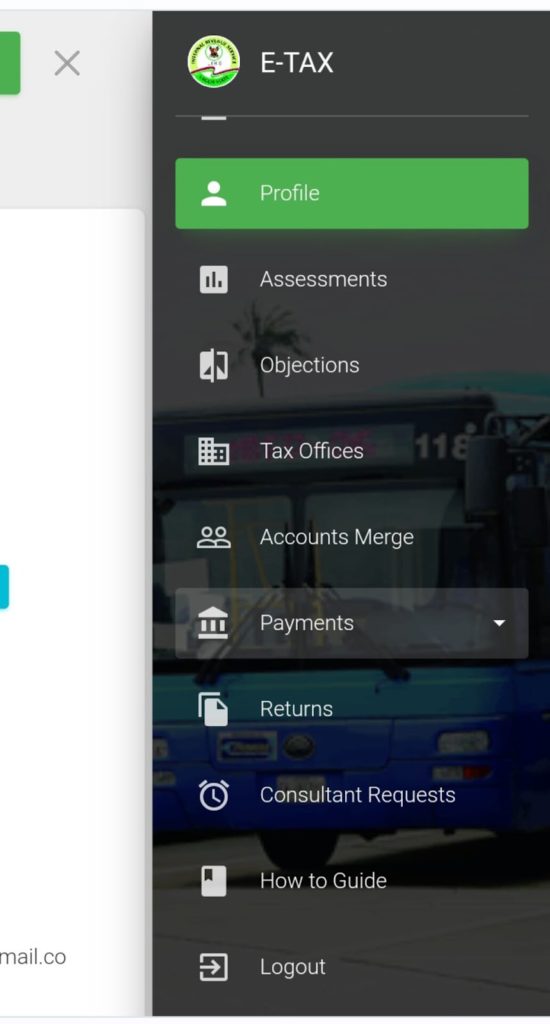

Step 3: Make payments and file returns

Once you log in, you’ll find a dropdown menu at the top right of the page. Here, you’ll find payment options, returns, and many more.

All you need do is click any and follow the prompts to carry out your desired tax-related transactions.

Final thoughts

Just like registering and filing taxes in African countries like Kenya, filing your tax returns in Nigeria with the LIRS eTax platform is a quick and convenient process. By following the steps outlined in this article, you can file your tax returns online, from the .comfort of your home or office, without the need to visit any physical tax offices. However, it is important to ensure that you provide accurate and up-to-date information to avoid any errors or penalties. If you have any questions or need assistance, you can contact LIRS via their website or hotline.