The BackEnd explores the product development process in African tech. We take you into the minds of those who conceived, designed and built the product; highlighting product uniqueness, user behaviour assumptions and challenges during the product cycle.

—

Ever wondered why two digital products offering the exact same services go off on two wildly different trajectories when they are launched? They may both attract similar interests at the start, users eager for something new offering to solve a challenge for them in fresh ways.

Then, one goes off to continue attracting and keeping new users while the other continues to suffer churn until it becomes a one-time wonder in the history of technology products.

There are many reasons why one digital product sticks better than another. Perhaps it solves a very recurring need or costs very little to use. Or maybe it offers a stellar user journey from a seamless onboarding process to the first transaction/activity and subsequent use. A new report titled Most Effective Digital Onboarding Strategies (PDF) suggests it’s the latter. 64% of responders favour apps that are easy to use.

The report, put together by LOOKA, Yux and identity verification company, Appruve, and which surveyed users in Ghana across a variety of demographics, sheds light on how users interact with onboarding processes across a number of digital solutions/channels particularly financial services, what works and what doesn’t.

For product developers and UX designers, it highlights the variables at play when building new products, designing how users interact with them and highlights the need to iterate in ways that appeal to the ease of useability that keep users engrossed with a digital product.

“At the end of the day, it [product development] is like a puzzle, like you’re in a jungle and there are a lot of different directions you can go in,” says Selma Kaldiroglu, Head of Products at Pariti, “The sooner you can experiment and find answers the quicker you can get out.”

In the financial technology sector, being able to carry out effective Know Your Customer (KYC) and customer due diligence (CDD) procedures is inextricably linked with this user experience during onboarding.

Lengthy onboarding questions put off new users

Given that 26% of responders, the highest in the group, say user experience diminishes when there are too many questions to answer during sign up, it is no surprise that, increasingly, financial technology solutions like digital banks are asking for less to help individuals create their accounts. With standard identity information and sometimes a biometric capture by way of a selfie, a digital bank can have you onboarded in ten minutes or less.

“There’s no part of KYC regulation, globally, that says you need to collect all KYC data immediately,” Paul Damalie, CEO, Appruve says.

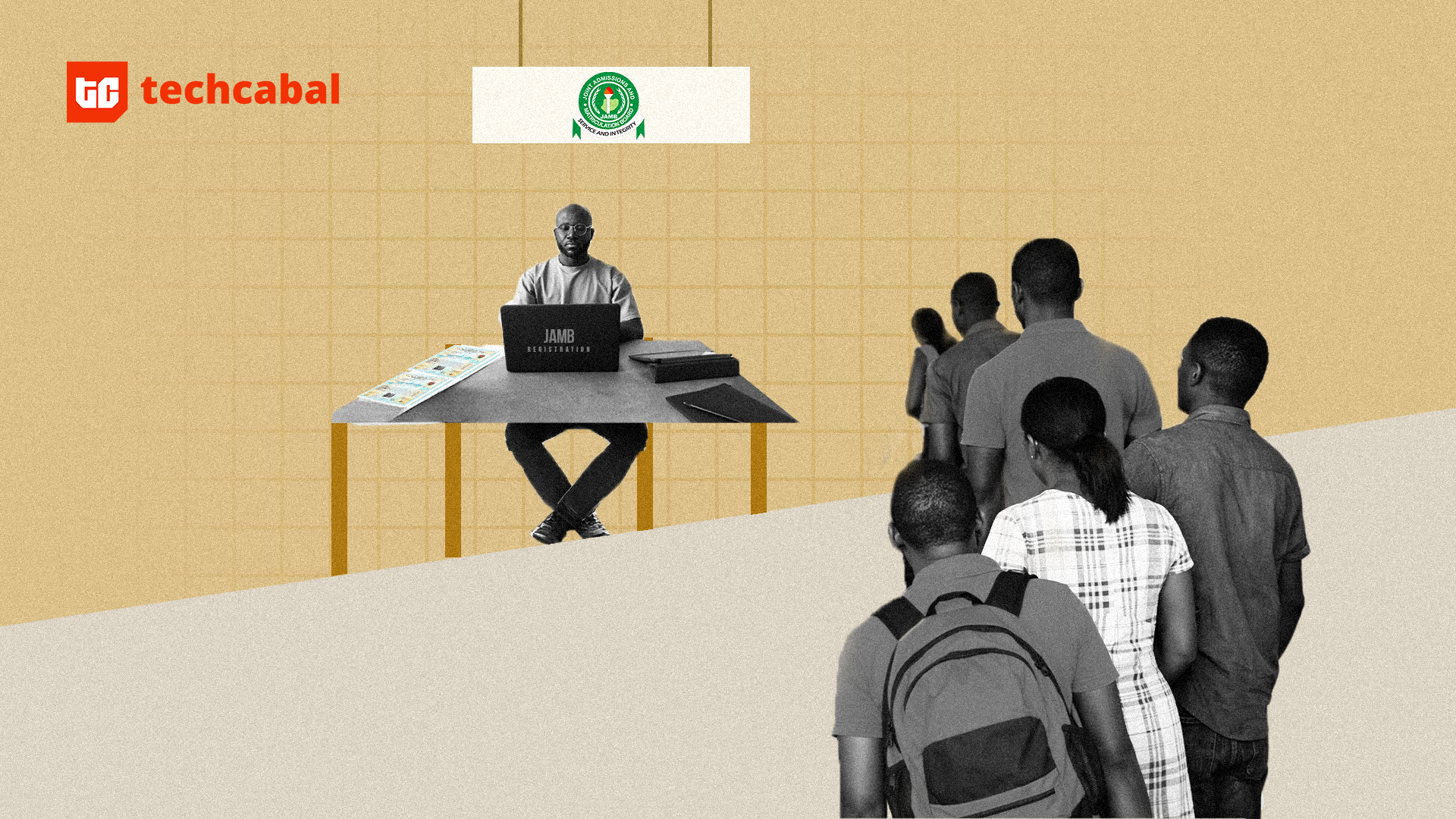

In 2012, Nigeria’s apex bank laid down a three-tiered Know Your Customer (KYC) procedure for all financial service providers in the country. The idea behind this document (PDF) was to drive inclusion by creating flexible requirements that allowed for the opening of low-value and low-risk bank accounts.

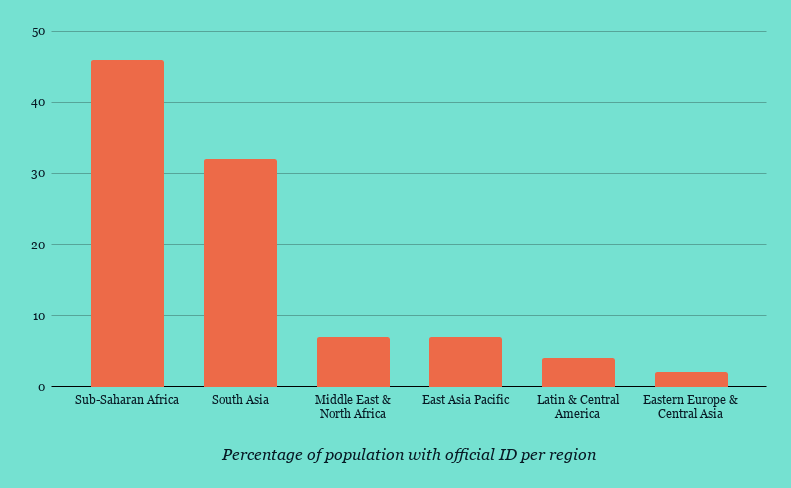

The Alliance for Financial Inclusion (AFI) says restrictive identity verification requirements are one of the hindrances to financial inclusion especially for underbanked and unbanked populations. For many of these individuals, official ID requirements like passports are often the stumbling block between owning a bank account and accessing other financial services that this comes with.

The tiered KYC procedure, which many other countries now have in-place, offers a staged collection of personal and biometric requirements unlocking greater access and functionality as it progresses.

“What it means is that this gives you [the product designer] an opportunity to stage the data you collect,” Damalie explains.

For a new user still trying to determine if they want to fully commit to using a service, pertinent personal identifiable information is often sufficient upfront: name, contact number, email address.

This addresses two other key concerns the report raises. User experience diminishes when too much personal information is required upfront. 67% of respondents surveyed quit an onboarding process for this reason. It also addresses the challenge of not having readily available some information or document certain onboarding processes require upfront.

“Eventually, you would have collected [and verified] the entire data that you need,” Damalie says.

Onboarding assistance and the human factor

One other challenge with onboarding particularly for financial service providers the report highlights is the availability on on-hand support during the process. Or a lack of it.

While 16% of respondents chose chat channels as an ideal way to ask for help, only 2% of them said they actually explored this channel when they needed help. 57% of respondents did not find chatbots useful.

“The reality is that when it comes to financial services, people want to know that they are entrusting their money to a real person,” Damalie says.

“So when you’re disintermediating [by introducing digital onboarding processes], you have removed that catch of the human interaction and it creates some doubts especially in emerging markets where we are used to physical transactions,” he explains.

While chatbots are useful in simultaneously addressing user inquiries and complaints, and importantly freeing up staff hours for more personnel-demanding tasks, the challenge remains making their input more personable to optimise user experience and effectiveness.

“You want to humanise the chatbots and make it feel like it is a real human being behind it, if possible, have humans behind the chat widgets and when you are not available, automate it,” advises Dmalie.

“People don’t want to feel like they are left aloof.”

Humanising a chatbot can be as simple as incorporating elements that give users the feel of chatting with a person on the other side.

This can be reflected in the use of colloquial or conversational language or the most popular: creating them into characters with names and personalities like the United Bank for Africa has done with its chatbot, Leo.

Largely, users understand the security reasons why financial technology solutions require personal bits of information (49% of respondents in this report). However, obtaining them does not have to be a drudgery especially through digital channels that hold the promise of ease and simplicity. This is the task for product developers and UX designers as they create and think about those for whom they build.