I would really love to look into the future to see what I can find you know. Especially for tech. There are so many things happening and a lot to anticipate about what could be the next big thing.

In 2019, the big things were mobility companies, fintechs, funding rounds, Jumia IPO and stock crash, foldable phones, among a few others. Some of these trends looked obvious at the start of the year, while for the others, nobody saw them coming, like bike-hailing.

So for 2020, what should we be expecting in the African tech ecosystem? What big trends should we be looking at as we enter into the new year?

Here’s what I think we should look out for or not expect to happen.

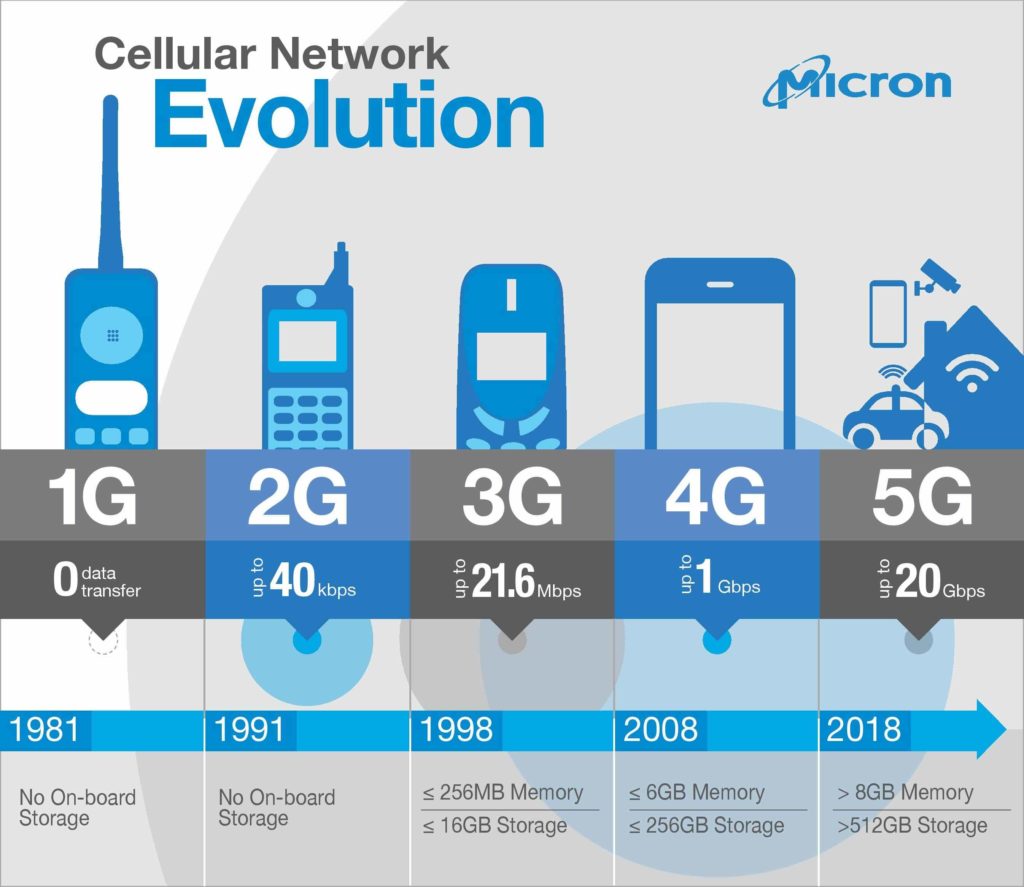

Slow 5G Progress may continue

5G won’t gain traction in Africa in 2020. Why? Because very few African telecom companies are psyched about it. Why aren’t they psyched about it? Because the African market does not have both the infrastructure needs, business needs or even the broadband penetration to suggest that 5G should be the next big focus. It doesn’t help too that 5G is very expensive to build. In Nigeria, Africa’s biggest economy, mobile broadband penetration is still less than 40%; that’s small for a market where there are over 100 million subscribers. Over the last few years, telcos in the country have amped up marketing efforts to get people to switch over to 4G. The final nail on the coffin? “3G is much more relevant in most of our markets,” said MTN Group’s CEO, Rob Shuter.

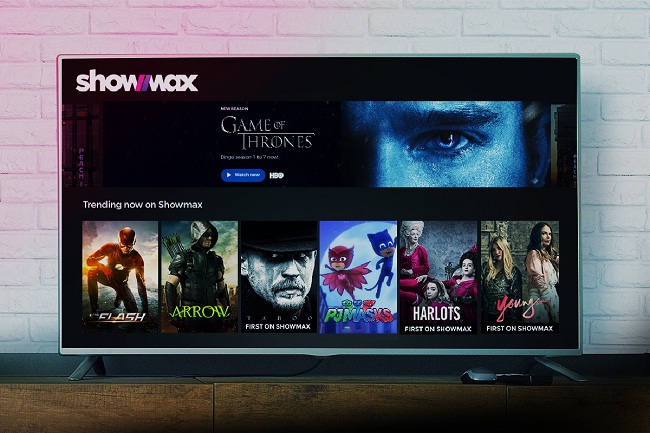

MultiChoice could become a streaming heavyweight

I started the year thinking MultiChoice’s DStv and ShowMax were going to suffer as Netflix pushed stronger into the African market. Within two years of entering the African market, Netflix garnered 400,000 subscribers in South Africa alone. But then two things happened. First, Netflix faced increased competition in the American market from Apple, Amazon and the almighty Disney. Secondly, Multichoice tweaked its digital strategy. The South African company appears to be working to get its streaming services to be on par with Netflix. It introduced live sports viewing on ShowMax, then launched a cheaper price plan for it. But in 2020, it plans boost live TV viewing for African customers by detaching DStv Now from the decoder DStv. So people don’t already have to own a DStv decoder to watch live TV. That plan will kick in March 2020, so we’re watching it closely.

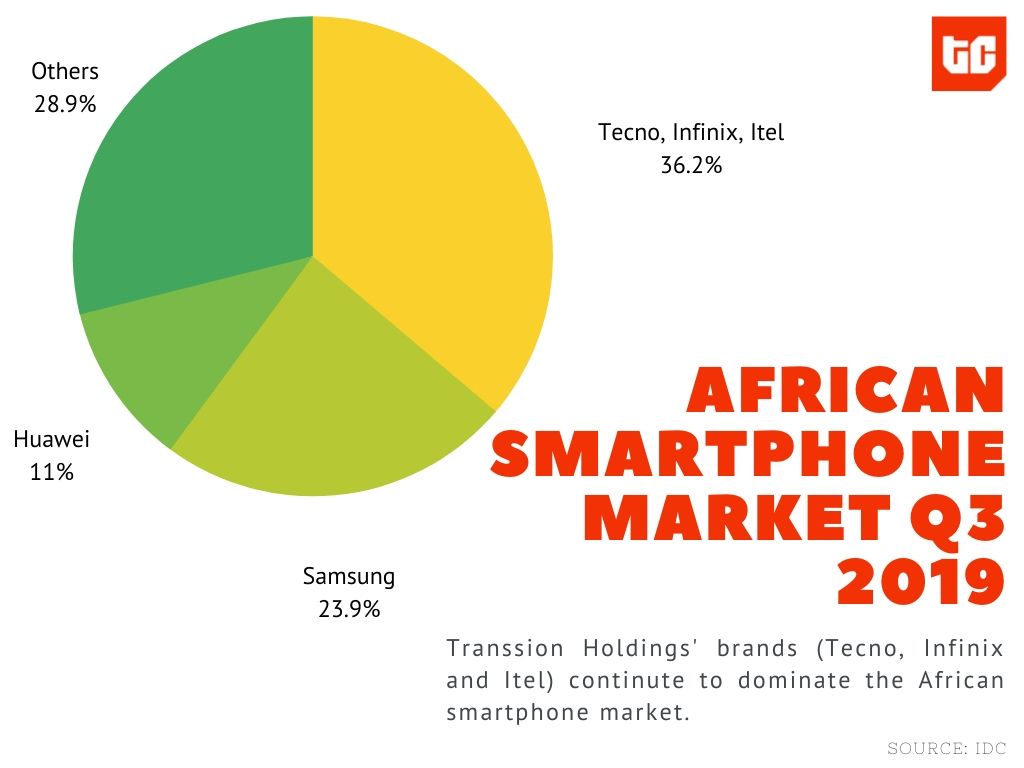

Smartphone market leadership could change

Transsion Holdings leads the African phone market. It owns Tecno, Infinix and Itel, giving it a formidable market share of over 30% in the region. But here’s the thing, Transsion devices are becoming too predictable and somewhat stale for customers. They have great distribution though. Yet people buy their devices primarily because they are cheap, and not because of the camera. However other phone brands have caught on and now produce cheaper devices that pack a lot of features. According to the IDC, Nokia and Samsung doubled their low end smartphone sales in the third quarter. If they continue, and Xiaomi and the others follow suit, I’m sorry Transsion your lead is in jeopardy.

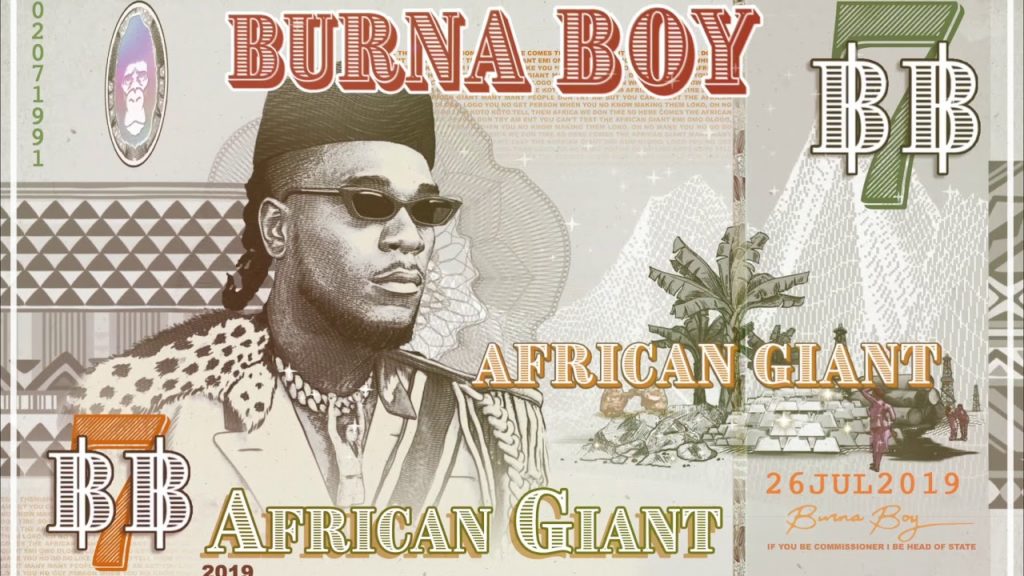

Songs could get even shorter

Burna Boy’s latest album had 19 songs, but it was a couple of seconds shorter than his previous album that had just 12 songs. Yet his most streamed songs on both Spotify and Apple Music were his short songs; songs less than three minutes and fifteen seconds. He amassed over 50 million streams on just these songs alone. We may see more artistes do this in 2020 as people’s attention spans reduce and the number of musical content explode.

Emerging Tech may witness more use cases in Africa

Distributed ledger technology (blockchain), Artificial intelligence, Extended Reality (AR and VR), and Quantum Computing. Together these four techs are the emerging tech or simply DARQ. There’ll be more spotlight on the blockchain as companies like Facebook continue to tout its Libra currency. The focus on AI will be important because it concerns automation and the future of work. AR and VR are going to see more use cases on the continent. Although both are trendy for gaming and enterprise technology, in Africa companies are looking for how to reasonable uses cases. Microsoft, Google and IBM have set up AI and VR offices in Africa to do exactly that.

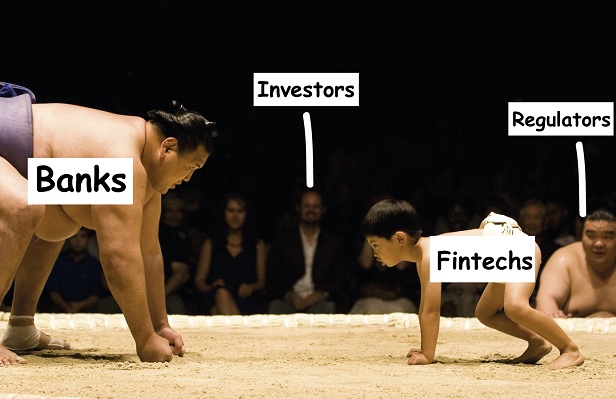

Competition between banks and fintechs will be Fierce

Digital banks (like Kuda and Revolut) are the worst nightmare for banks. Providing branchless and inexpensive financial services, digital banks pose a serious threat to the bricks and mortar model many banks operate today. The headache for banks is accentuated by the fact that other fintechs are also decoupling financial services like lending (Fairmoney), wallets (Wallets.ng), investing (CowryWise) and even savings (PiggyVest), further reducing the relevance of banks. Of course, not all fintechs want to compete with banks. Startups like Migo provide credit as a service facility for banks, providing them with the technology to do more effective lending operations.

Regardless, recently banks have fought back. A few of them have developed their own fintech clones, like Marcus a digital bank launched by American banking heavyweight Goldman Sachs. Goldman Sachs was strictly focused on investment banking services until it launched Marcus in 2016. Another bank, Standard Chartered recently flagged off its own digital bank, offering retail banking services for the first time in many countries like Nigeria. Other banks have no full blown digital alternatives, but they are increasingly using tech to decouple certain services. Sterling Bank and GT Bank, for instance, have developed impressive digital lending platforms that rival fintech startups.

We’re going to see this competition between banks and fintechs playout more often in 2020.

Payment startups may have to change their business models

Payment is boring. You simply help people to collect and send money so what? But the cool part is how companies can create services to get digital payment services to more people. In late 2019, the CBN reminded startups that simply introducing cheaper transfer costs is not enough. The regulator has slashed bank transfer charges three ways, reducing fees to as low as ₦35. Startups need to get innovative to get more people across continent to pay digitally. For instance you have OPay which had to develop a number of new verticals just to get more people to use its wallet. In 2020, more payment companies are going to experiment with new payment models that would really exciting and could drive more financial inclusion.

More African tech companies will expand to other regions

African tech companies rarely expand abroad. Yet in 2019, we saw a number of African tech companies expand to other regions, either to try out their innovations there or simply to try to dominate these markets. For instance, Nigeria’s Lidya expanded to Eastern Europe and Migo expanded to Brazil. Telecom behemoth IHS Towers recently expanded to Latin America. Meanwhile Flutterwave announced it is hiring new staff in countries like China and India. This trend may continue in 2020.

More startup funds will target African tech companies

Over the last 12 months, 20 new Africa-focused startup funds were launched. From seed stage VCs to growth stage venture funds, more money could pour into African startups as investors continue to beam attention at the continent. Beyond sizes, some funds are niche, targeting particular industries or regions. In addition to new VC funds, some private equity firms on the continent are considering reducing their ticket sizes too. Aside from the risk factor, many PEs write a minimum of $10 million for companies. That’s too high for a promising startup looking for less than $1 million seed funding. So the chatter is that PE’s are considering reducing their ticket sizes so they can invest smaller amounts in startups.

Regulation will remain a big topic

Regulating tech companies will be an important conversation in 2020. Regulation is already a big concern for fintech companies and it became a big concern for mobility companies like Gokada, MAX, Swvl and even Uber in Africa. There are now regulatory conversations about drone technology too. With more fintechs attempting to develop In 2020, these regulatory concerns won’t go anywhere.

Digital Taxes

This was an important but quiet issue in 2019. Governments want to tax tech companies that make revenue from their countries. To do that they’ll have to either go unilaterally to tax these companies and in turn piss off the president of the United States. Or they could work together to create global rules regarding this tax issue. They’re still undecided so a couple of countries like Kenya, Italy, France and the UK have set up unilateral digital tax laws. The Organisation for Economic Cooperation and Development (OECD) is working on a proposal that could create acceptable rules regarding digital taxes. It’s still in the works, but expect more conversation regarding this in 2020.