Editor’s Note

- Week 37, 2022

- Read time: 5 minutes

For better or worse, this week brought even more regulatory drama, interesting partnerships and brow-raising news from popular startups. Meanwhile, Brazil and Singapore made major entries into the African tech ecosystem. Read on to learn more!

Immaculata Abba, Senior Editor, TechCabal.

Editor’s Picks

|

Kenya drops money laundering casesNearly a dozen Nigerian companies, including fintech unicorn Flutterwave, have been entangled in money laundering scandals in Kenya this year. This week, the Asset Recovery Agency in Kenya dropped lawsuits against three of them and unfroze their bank accounts. Which companies were acquitted? |

|

Kuda loses over ₦6 billionNigerian neobank Kuda has been bleeding cash for the past two years. It lost ₦6,092,554,866 ($14,214,681) in 2021, 602% of its 2020 loss. It seems that defaulted loans, rising personnel costs, and the price of advertising are the culprits. Learn more. |

|

Edtech Edukoya pivots to fintech?Is Edukoya shedding weight for flight? Former employees of Nigerian Edtech Edukoya claim that the company is pivoting to fintech. They say that it fired most of its staff, retaining mostly developers to build its upcoming fintech product. Read Edukoya’s response. |

|

Adobe buys Figma for $20 millionIf you can’t beat them, buy them. American design company Adobe has acquired one of its biggest rivals—design startup Figma—for $20 billion. The news of acquisition has stirred unrest among designers in Africa. Find out why. |

|

MultiChoice limits choiceMultichoice doesn’t want multi-users on one streaming account unless they are paying more money. Except for ShowMax, Multichoice will limit streaming to one account on all its streaming platforms. How MultiChoice will do it. |

|

EBANX expands into AfricaCash is still king in Africa. The decade-old Brazilian payments unicorn, EBANX, says that Africa’s current state of payments reminds it of Brazil’s early days in fintech. It has expanded into Africa to push the boundaries of fintech. Learn about EBANX’s plans. |

Event: T-minus 6 Days Until #FOC2022

If you haven’t signed up to attend #FOC2022, what are you waiting for?

At this year’s Future of Commerce 2022, our conversations will centre around ‘money on the streets.’ More than 30 business leaders and experts will discuss how innovation in payments, social media, and logistics are powering Africa’s commerce. We will discuss the current state, challenges, and solutions, from the key players in the commerce ecosystem. #FOC2022 is a conference you don’t want to miss, so click here to sign up now.

|

Uber and Bolt face hurdles in KenyaIn Kenya, regulations are threatening the profitability of mobility companies Uber and Bolt. Something similar happened in Tanzania. Will Uber leave Kenya like it left Tanzania? Learn more. |

|

Kenya gives digital lenders a 3-day ultimatumTo curb exploitation and safeguard borrowers’ rights, Kenya established regulations to guide the digital lending sector. Now, it has issued a three-day ultimatum, threatening to shut down digital lenders who haven’t conformed to the new rules. Learn what the rules are. |

|

SafeBoda gets carsSafeBoda is getting more wheels in the game. For 7 years, it offered only bike-hailing. Now it’s adding car rides to its mobility services in Nigeria and Uganda. The startup says its ride-hailing services will be completely cashless. Learn more. |

|

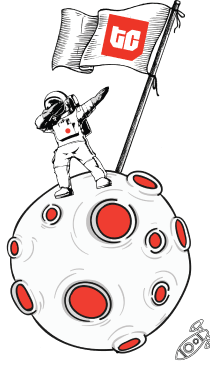

Rain valued at $1 billionRain, the South African data-only mobile network operator, is now valued at about $1 billion. African Rainbow Capital Investments, its second largest investor, valued Rain so because Rain maintained high profitability before and after the easing of Covid-19 restrictions. Read more. |

|

Orange power wallet transfers in BotswanaPartnering with pan-African fintech Cellulant, Orange’s mobile money service (Orange Money) has made card-to-wallet transfers possible for 8 banks in Botswana. Learn more. |

Who brought the money this week?

- Kenyan-based insurtech company Turaco raised $10 million in a series A equity round led by AfricInvest (through the Cathay Africinvest Innovation Fund) and Novastar Ventures.

- Kippa, a Nigerian financial management app, raised $8.4 million in an undisclosed round.

- BusyMed also raised an undisclosed amount from Entrepreneurs for Entrepreneurs Africa (E4E Africa).

TC Crossword: Guess the gadget

I found ATM because I am after the money. Stop wondering whether an ATM is a gadget or not, start wondering what the other gadgets are.

What else to read this weekend?

- As university strikes linger, Nexford presents Nigerians with affordable US-licensed degrees.

- Is Capiter the latest casualty of the venture funding downturn in Africa?

- The Next Wave: There was nothing special about raising $5 billion.

- Adaverse is backing a diverse range of Web3 startups across Africa.

- How to easily understand blockchain and key into it.

- How to build a website for small business in five steps.

- Meet the 13 Nigerian community leaders fueling Africa’s tech talent pipeline.

- Entering Tech #003: How to become a no-code developer.

- Nigeria can’t support its tech talent. Now, they are leaving.

- Mastering LinkedIn is an essential skill for African entrepreneurs who want to succeed.

Written by: Ngozi Chukwu

Edited by: Immaculata Abba

On Friday, the 23rd of September, TechCabal in partnership with Moniepoint (by TeamApt) will host the most important players in tech and business on and off the continent to discuss the future of commerce in Africa. Register now to attend.